As filed with the Securities and Exchange Commission on November 8, 2022.

Registration No. 333-267392

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

Amendment No. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

ASP Isotopes Inc.

(Exact name of Registrant as specified in its charter)

____________________

|

Delaware |

2890 |

87-2618235 |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

433 Plaza Real, Suite 275

Boca Raton, Florida 33432

(561) 709-3034

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

____________________

Paul E. Mann

Chairman and Chief Executive Officer

ASP Isotopes Inc.

433 Plaza Real, Suite 275

Boca Raton, Florida 33432

(561) 709-3034

(Name, address, including zip code, and telephone number, including area code, of agent for service)

____________________

Copies to:

|

Brenda Hamilton, Esq. Boca Raton, Fl 33432 |

Ross D. Carmel, Esq. |

____________________

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated file |

☐ |

Accelerated filer |

☐ |

|||||

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|||||

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated November 8, 2022

1,500,000 Shares

ASP Isotopes Inc.

Common Stock

____________________

This is the initial public offering of shares of common stock of ASP Isotopes Inc. We are offering 1,500,000 shares of common stock.

The selling stockholders identified in this prospectus are offering an additional 2,057,500 shares of our common stock, which we refer to as the “selling stockholder shares.” We will not receive any proceeds from the sale of selling stockholder shares. The selling stockholder shares will not be purchased by the underwriters or otherwise included in the underwritten offering of our common stock in this initial public offering. The selling stockholders may sell or otherwise dispose of their shares in a number of different ways and at varying prices, but will not sell any selling stockholder shares until after the closing of this offering. See “Selling Stockholders — Plan of Distribution.” We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses, if any) relating to the registration of the selling stockholders’ shares of common stock with the Securities and Exchange Commission.

No public market currently exists for our common stock. We have applied to list our common stock on the Nasdaq Capital Market under the symbol “ASPI.” The closing of this offering is contingent upon the successful listing of our Common Stock on the Nasdaq Capital Market.

We anticipate that the initial public offering price per share will be between $4.00 and $5.00.

We are an “emerging growth company” as defined under the federal securities laws, and as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 9 of this prospectus.

____________________

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

____________________

|

Per Share |

Total |

|||||

|

Initial public offering price |

$ |

|

$ |

|

||

|

Underwriting discount(1) |

$ |

|

$ |

|

||

|

Proceeds, before expenses, to ASP Isotopes Inc.(1) |

$ |

|

$ |

|

||

____________

(1) We have agreed to pay Revere Securities LLC, as representative of the underwriters named in this prospectus, or the Representative, a discount equal to 7.0% of the gross proceeds of the offering. See the section titled “Underwriting” for additional information regarding underwriting discounts, commissions and estimated offering expenses.

To the extent that the underwriters sell more than 1,500,000 shares of common stock, the underwriters have a 45-day option to purchase up to an additional 225,000 shares of common stock from us at the initial public offering price less the underwriting discount.

____________________

The underwriters expect to deliver the shares against payment in New York, New York on , 2022.

Sole Book Running Manager

Revere Securities LLC

____________________

Prospectus dated , 2022.

|

Page |

||

|

1 |

||

|

9 |

||

|

43 |

||

|

45 |

||

|

46 |

||

|

47 |

||

|

48 |

||

|

50 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

52 |

|

|

64 |

||

|

83 |

||

|

89 |

||

|

97 |

||

|

101 |

||

|

103 |

||

|

107 |

||

|

112 |

||

|

Material U.S. Federal Income Tax Considerations to Non-U.S. Holders |

114 |

|

|

118 |

||

|

122 |

||

|

122 |

||

|

122 |

||

|

F-1 |

____________________

You should rely only on the information contained in this prospectus and any free writing prospectus that we may provide to you in connection with this offering. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with different information or to make any other representations, and neither we, the selling stockholders nor the underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only under circumstances and in jurisdictions where it is lawful to do so. Neither we, the selling stockholders nor any of the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we, the selling stockholders nor any of the underwriters have done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

i

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes included elsewhere in this prospectus before making an investment decision. Unless the context otherwise requires, the terms “Company,” “we,” “us,” “our” or similar terms refer to ASP Isotopes Inc. together with its consolidated subsidiaries. References to the “selling stockholders” refer to the selling stockholders named in this prospectus.

The Company

We are a pre-commercial stage advanced materials company dedicated to the development of technology and processes that, if successful, will allow for the production of isotopes that may be used in several industries. We have an exclusive license to use proprietary technology, the Aerodynamic Separation Process (“ASP technology”), originally developed and licensed to us by Klydon Proprietary Ltd (“Klydon”), for the production, distribution, marketing and sale of all isotopes. Our initial focus is on the production and commercialization of enriched Molybdenum-100 (“Mo-100”). Klydon has agreed to provide us a first commercial-scale Mo-100 enrichment plant located in South Africa with a manufacturing capacity of 20 kg/year of 95% enriched Mo-100 when fully operational. We believe that the Mo-100 we may develop using the ASP technology has significant potential advantages for use in the preparation of nuclear imaging agents by radiopharmacies and others in the medical industry. We also intend to use the ASP technology licensed to us by Klydon to produce enriched Uranium-235 (“U-235”). We believe that the U-235 we may develop using the ASP technology may be commercialized as a nuclear fuel component for use in the new generation of HALEU-fueled small modular reactors that are now under development for commercial and government uses.

We may also seek to use the ASP technology to separate Silicon-28, which we believe has potential application in the quantum computing target end market, and Carbon-14, which we believe has potential application in the pharma/agrochem target end market. In addition, we are considering future development of the ASP technology for the separation of Zinc-68, Ytterbium-176, Zinc-67, Nickel-64 and Xenon-136 for potential use in the healthcare target end market, and Chlorine -37 and Lithium-6 for potential use in the nuclear energy target end market.

We operate principally through subsidiaries: ASP Isotopes Guernsey Limited (the holding company of ASP Isotopes South Africa (Proprietary) Limited), which will be focused on the development and commercialization of high value, low volume isotopes for highly specialized end markets (such as Mo-100 and others, including Silicon-28); Enriched Energy LLC, which will be focused on the development and commercialization of uranium for the nuclear energy market; and ASP Isotopes UK Ltd, which is the licensee of the ASP technology under the exclusive license agreement with Klydon.

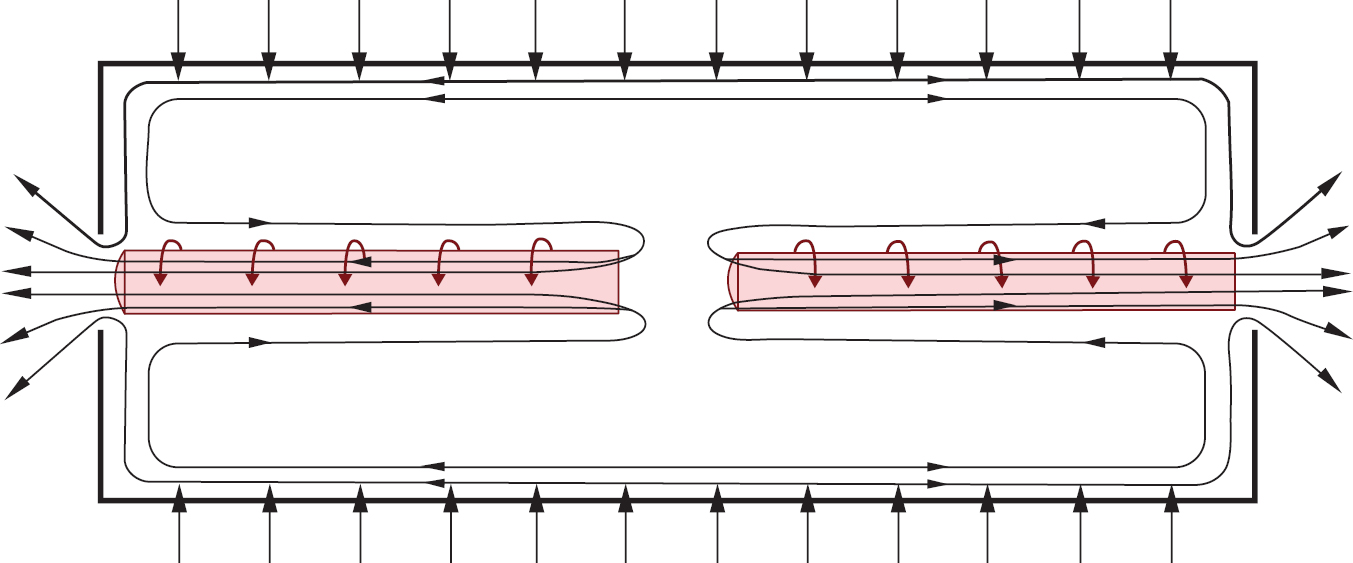

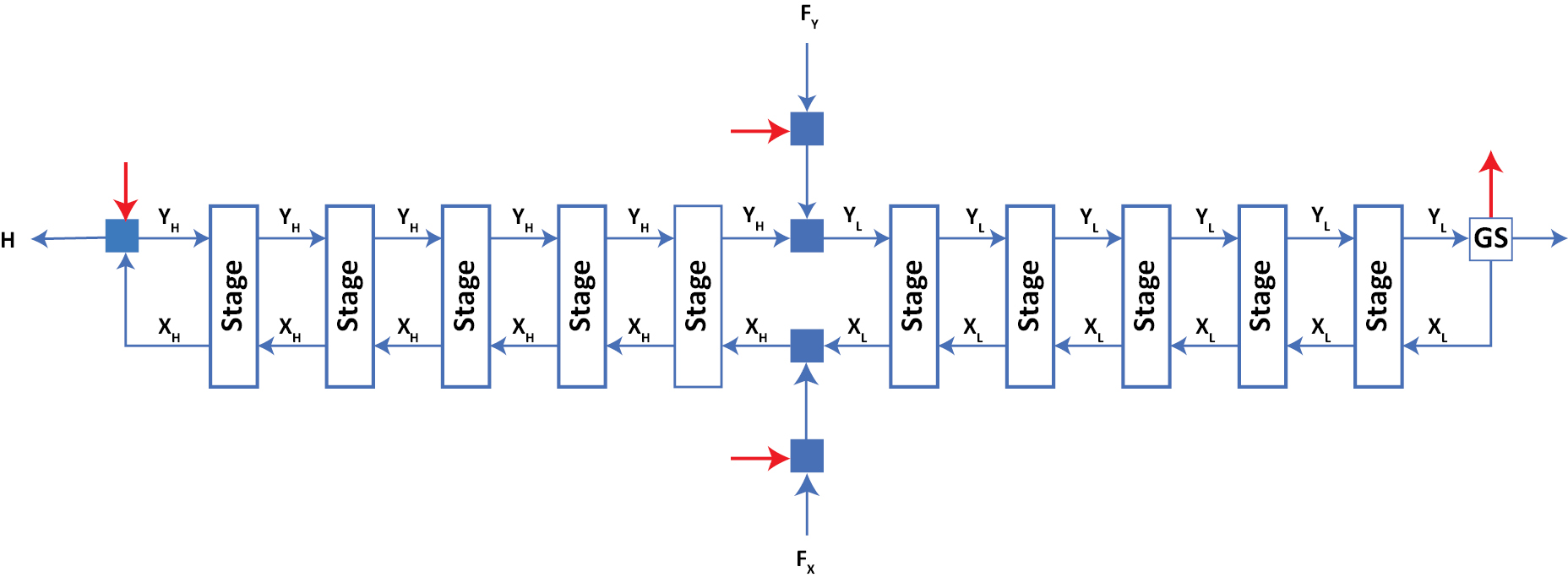

Background

We were incorporated in Delaware in September 2021 to acquire assets and license intellectual property rights related to the production of Mo-100 using the ASP technology. The aerodynamic separation technique has its origins in the South African uranium enrichment program in the 1980s and the ASP technology has been developed during the last 18 years by the scientists at Klydon. In Klydon’s testing, the ASP technology has demonstrated efficacy and commercial scalability in the enrichment of oxygen-18 and silicon-28. In July 2022, ASP Isotopes UK Ltd, as licensee, entered into a license agreement with Klydon, as licensor, pursuant to which ASP Isotopes UK Ltd acquired from Klydon an exclusive license to use, develop, modify, improve, subcontract and sublicense certain intellectual property rights relating to the ASP technology for the production, distribution, marketing and sale of all isotopes produced using the ASP technology (the “Klydon license agreement”). The Klydon license agreement is royalty-free, has a term of 999 years and the license is worldwide for the development of the ASP technology and the distribution, marketing and sale of isotopes. Future production of isotopes is limited to member countries of the Nuclear Suppliers Group. We have no products approved for commercial sale or existing customers and have generated no revenues to date. We have not yet built a functioning Mo-100 or U-235 enrichment plant or even demonstrated the ability to produce Mo-100 or U-235 using the ASP technology.

1

Dr Einar Ronander, who serves as Chief Scientific Adviser to our board of directors, and Dr Hendrik Strydom, one of our directors, previously co-founded and currently serve as Executive Chairperson and Chief Executive Officer, of Klydon. Dr Ronander and Dr Strydom are the controlling shareholders of Klydon through Isotope Separation Technology (Pty) Ltd, a company jointly owned by Dr Ronander and Dr Strydom and the largest shareholder of Klydon. Dr Ronander and Dr Strydom each own approximately 11.9% of our outstanding shares of common stock. Immediately following the closing of this offering, Dr Ronander and Dr Strydom will each own 11.2% of our outstanding shares of common stock (or approximately 11.1% of our common stock, if the underwriters exercise in full their option to purchase additional shares of our common stock in this offering). For more information on our transactions with Klydon, see the section of this prospectus entitled “Certain Relationships and Related Party Transactions — Our Relationship with Klydon Proprietary Limited”).

Our Strategy

Our goal is to develop technology and processes that, if successful, will allow for the production of isotopes that may be used in the medical isotopes, nuclear power or other industries. Key elements of our strategy to achieve this goal include:

• Complete development and commissioning of Mo-100 enrichment facility located in Pretoria, South Africa.

• Demonstrate the capability to produce Mo-100 using the ASP technology and capitalize on the opportunity to solve the Mo-99 supply chain challenges in the existing medical isotope market.

• Introduce Mo-100 produced using ASP technology as an alternative and potentially more convenient production route for Tc-99m.

• Explore commercial opportunities for Silicon-28 and other light isotopes that may be produced using the assets comprising a dormant Silicon-28 aerodynamic separation processing plant acquired from Klydon in July 2022 (which are also located in Pretoria, South Africa).

• Continue identifying potential offtake customers and strategic partners for Mo-100. We expect limited commercial activity for Mo-100 in the United States during the next two to three years and we anticipate that most of our initial revenues from future sales of our Mo-100 will be derived from countries in Asia and EMEA (Europe, Middle East and Africa).

• Demonstrate the capability to produce high-assay low-enriched uranium (HALEU) using the ASP technology and meet anticipated demand for the new generation of HALEU-fueled small modular reactors and advanced reactor designs that are now under development for commercial and government uses.

Mo-100 Regulatory Approvals

We have not sought any regulatory approval for the application of Mo-100. Currently, the sale or use of Mo-100 is not regulated by a healthcare regulator, such as the FDA, European Medicines Agency (EMA) or comparable foreign regulatory authorities. However, products such as Mo-99 and Tc-99m that are produced from Mo-100 in a cyclotron or a linear accelerator are regulated by healthcare regulators. Our future customers who may use Mo-100 to produce radiopharmaceuticals will likely require regulatory approval for their products. To date, only one healthcare regulator (Canada) has approved the use of Tc-99m produced from Mo-100 via a cyclotron. Obtaining regulatory approval is expensive and can take many years to complete, and its outcome is inherently uncertain. Our customers’ regulatory approval process may not be conducted as planned or completed on schedule, if at all, and failure can occur at any time during the process.

Intellectual Property

We have an exclusive worldwide license to use, develop, modify, improve, subcontract and sublicense certain intellectual property rights relating to the ASP technology for the production, distribution, marketing and sale of all isotopes produced using the ASP technology. The intellectual property rights granted to us through the Klydon license agreement include all existing and/or future proprietary rights of Klydon relating to the ASP technology, whether or not such rights have been registered including the copyright, designs, know-how, patents and trademarks (although

2

Klydon currently has no such patents, patent applications or copyrights). Klydon has spent the last 18 years and tens of millions of dollars developing the aerodynamic separation technique used in the ASP technology, generating critical trade secrets. Neither we nor Klydon have any existing patents, pending patent applications or copyrights. To date, we and Klydon have relied exclusively on trade secrets and other intellectual property laws, non-disclosure agreements with our respective employees, consultants, vendors, potential customers and other relevant persons and other measures to protect our intellectual property, and intend to continue to rely on these and other means.

Recent Developments

On October 25, 2022, we received a letter (the “NMS Letter”) from a law firm acting on behalf of Norsk Medisinsk Syklotronsenter AS (“NMS”), asserting, among other things, that the grant of a license to the ASP technology to ASP Isotopes Inc. by Klydon violates a pre-existing exclusive sub-license to the ASP technology for the separation of isotopes of Molybdenum that have medical applications granted to Radfarma, as more fully described below. NMS and ASP Isotopes had previously been briefly in discussions regarding a potential future collaboration on technology and product development. However, these preliminary discussions have not been active for several months, after the death of a lead NMS scientist and ASP Isotopes Inc.’s decision to explore other options.

The NMS Letter makes reference to: (1) a license agreement entered into on October 25, 2013 by Klydon and API Labs Pharmaceuticals (Proprietary) Limited (“API Labs”) to license the ASP technology for enriching certain isotopes of the element Molybdenum (“2013 API Labs License”); and (2) an exclusive sub-license to the ASP technology granted on October 1, 2019 to Radfarma, as licensee, by API Labs and SaPhotonica Limited (“SaPhotonica”), as licensors (the “2019 Radfarma Sub-License”). The NMS Letter states that Radfarma is a joint venture that is 45% owned by NMS and 45% owned by SaPhotonica.

The NMS Letter asserts, among other things, that the grant of a license to the ASP technology to ASP Isotopes Inc. by Klydon violates a covenant in the 2019 Radfarma Sub-License that the licensors shall not be entitled, directly or indirectly, to use, grant or otherwise give the rights, or any similar rights, which were granted to Radfarma under the 2019 Radfarma Sub-License to any other person for use in the territory. The sub-license granted to Radfarmain the 2019 RadfarmaSub-License related to the use of intellectual property rights related to the ASP technology for the separation of isotopes of Molybdenum that have medical applications. “Territory” is defined in the 2019 Radfarma Sub-License as “the Kingdom of Norway for the construction of the 20-kilogram capacity plants; and means the international market where distribution agreements can be produced.” The NMS Letter asserts that while Klydon purported to give to ASP Isotopes Inc. a license to market the ASP technology globally, these rights were already granted to Radfarma.

The NMS Letter includes a request for ASP Isotopes Inc. to enter into discussions for an agreement with NMS based on terms proposed in previous correspondence from NMS. The previous correspondence from NMS included the following key prerequisites to a possible cooperation between NMS and ASP Isotopes Inc.:(1) NMS will be granted the right to set up an enrichment facility for a Mo-100 in Norway; (2) NMS will be granted the exclusive rights to sales, marketing, and distribution in Europe, while ASPI gets similar rights for the rest of the world; and (3) NMS will support the development of the Mo-100 target production and Mo-99 generator production and if required the sales operations of ASPI.

The NMS Letter does not include a threat of litigation against ASP Isotopes Inc. or any parties to the 2013 API Labs License or 2019 Radfarma Sub-License. However, if the licensed rights granted to us are found to be invalid or unenforceable (in whole or in part), or if our exclusive license agreement with Klydon is terminated or Klydon, as licensor, fails to abide by the terms of our exclusive license agreement, our ability to commercialize our future isotopes would suffer and our business, results of operations and financial condition may be adversely affected. If the prior sub-license granted to Radfarmais found to be valid, we would be required to cease using the ASP technology for the separation of isotopes of Molybdenum that have medical applications (unless we were able to obtain a license from Radfarma), and we would focus our business operations on the enrichment of isotopes other than Molybdenum. For example, instead of continuing to pursue the production of Molybdenum-100, we could focus on the production and commercialization of zinc, silicon and/or chlorine using the ASP technology. We expect that our Mo-100 plant in South Africa would need to be redesigned and retrofitted in order to produce other isotopes, which would take approximately six months and cost approximately $1 million. See “Risk Factors — Risks Related to Our Intellectual Property” — “We have received a letter asserting that the license for the ASP technology granted to us from Klydon, which is critical to our business, may be invalid because these rights were already granted to a third party, Radfarma” and “Our license for the ASP technology with Klydon may be found to infringe third party intellectual property rights.”

3

Based on information currently available, and after consultation with legal counsel in South Africa, management believes that our exclusive license for the enrichment of Molybdenum-100 and all other isotopes from Klydon are valid and the company will vigorously defend its rights.

Summary Risk Factors

Investing in our common stock involves substantial risks, which are discussed more fully under the heading “Risk Factors” immediately following this summary. You should carefully consider all the information in this prospectus, including under “Risk Factors,” before making an investment decision. The risks described under the heading “Risk Factors” may cause us to not realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our strategy. Some of the more significant challenges include the following:

• We have a very limited operating history, and we have incurred losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future. We may never generate any revenue or become profitable or, if we achieve profitability, we may not be able to sustain it.

• The report of our independent registered public accounting firm for the period from September 13, 2021 (inception) through December 31, 2021 contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.”

• Even if this offering is successful, we will require substantial additional capital to finance our operations, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our development efforts or other operations.

• To become and remain profitable, we must succeed in developing and eventually commercializing isotopes that generate significant revenue. This will require us to be successful in a range of challenging activities, including completing research and development activities relating to our ASP technology, obtaining applicable regulatory approval for future isotopes, if any, and manufacturing, marketing and selling any future isotopes. We are only in the process of completing research and development activities relating to our ASP technology.

• Because we have targeted both Mo-100 and U-235 for production using the ASP technology, we may expend our limited resources to pursue a particular isotope and fail to capitalize on another isotope that may be more profitable or for which there is a greater likelihood of commercial success.

• We face substantial competition, which may result in others developing or commercializing isotopes before or more successfully than us.

• The regulatory approval processes of the FDA and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if our customers are ultimately unable to obtain regulatory approval for our Mo-100, our business will be substantially harmed.

• Klydon currently performs or supports many of our development activities and will continue to do so after the closing of this offering pursuant to our turnkey agreement, and if we are unable to replicate or replace these functions if this services agreement is terminated, our operations could be adversely affected.

• Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval.

• We have identified a material weakness in our internal control over financial reporting, and if our remediation of this material weakness is not effective, or if we experience material weaknesses in the future or otherwise fail to implement and maintain an effective system of internal controls in the future, we may not be able to accurately report our financial condition or results of operations which may adversely affect investor confidence in us, and as a result, the value of our common stock.

• Sales of a substantial number of shares of our common stock by our existing stockholders, including the selling stockholders, in the public market, or the perception that such sales could occur, could cause our stock price to fall.

4

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

• reduced obligations with respect to financial data, including presenting only two years of audited financial statements and only two years of selected financial data;

• an exemption from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act;

• reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements, and registration statements; and

• exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and, therefore, we will not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies or that have opted out of using such extended transition period, which may make comparison of our financial statements with those of other public companies more difficult. We may take advantage of these reporting exemptions until we no longer qualify as an emerging growth company, or, with respect to adoption of certain new or revised accounting standards, until we irrevocably elect to opt out of using the extended transition period.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. We may choose to take advantage of some but not all of these reduced reporting burdens.

Corporate Information

We were incorporated in Delaware in September 2021. Our principal executive offices are located at 433 Plaza Real, Suite 275, Boca Raton, Florida 33432, and our telephone number is (561) 709-3034. Our website address is www.aspisotopes.com. Information contained on, or that can be accessed through, our website is not part of and is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

5

The Offering

|

Common stock offered by us |

1,500,000 shares |

|

|

Selling stockholder shares |

2,057,500 shares |

|

|

Common stock outstanding after this offering |

|

|

|

Option to purchase additional shares of common stock offered in this offering |

|

|

|

Use of proceeds |

We estimate that the net proceeds to us from the sale of shares of our common stock in this offering will be approximately $5.4 million (or approximately $6.3 million if the underwriters’ option to purchase additional shares is exercised in full) based upon the assumed initial public offering price of $4.5 per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discount and estimated offering expenses payable by us. We will not receive any of the proceeds from the sale of selling stockholder shares. |

|

|

The principal purposes of this offering are to increase our capitalization and financial flexibility, create a public market for our common stock and thereby enable access to the public equity markets for us and our stockholders. We initiated Phase 1 of the Mo-100 development plan under the turnkey contract, targeting 5 kg/year of 95% enriched Mo-100, in October 2021 and we expect to complete this phase using cash on hand during the second half of 2022. Upon completion of Phase 1, we intend to use a portion of the net proceeds from this offering (currently estimated to be approximately $6.0 million of the total net proceeds) to initiate and fully fund Phase 2 of the Mo-100 development plan under the turnkey contract, which targets expanded production of up to 20 kg/year of 95% enriched Mo-100. We intend to use the remainder of the net proceeds we receive from this offering for research and development for potential additional isotopes that we may offer, as well as headcount costs, working capital and other for general corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

||

|

Voting rights |

Shares of our common stock are entitled to one vote per share. |

|

|

Underwriter compensation |

In connection with this offering, the underwriters will receive an underwriting discount equal to 7.0% of the offering price of the shares of common stock in the offering. In addition, we have agreed to: (i) reimburse the Representative for fees and expenses of legal counsel and other out-of-pocket expenses incurred in connection with this offering up to $150,000, plus closing costs not to exceed $12,900; (ii) reimburse the Representative for certain additional accountable expenses of the representative; (iii) provide the Representative with “tail” financing compensation under certain circumstances; and (iv) indemnify the underwriters for certain liabilities in connection with this offering. See “Underwriting”. |

6

|

Concentration of Ownership |

Upon the completion of this offering, our executive officers and directors, and their affiliates, will beneficially own, in the aggregate, approximately 34.1% of our outstanding shares of common stock, representing approximately 34.1% of the voting power of our outstanding shares of common stock (based on shares of common stock outstanding as of September 30, 2022 and excluding awards of 3,000,000 shares of restricted stock that we anticipate making upon the effectiveness of the registration statement of which this prospectus is a part). |

|

|

Risk factors |

You should read the section entitled “Risk Factors” and the other information included elsewhere in this prospectus for a discussion of some of the risks and uncertainties you should carefully consider before deciding to invest in our common stock. |

|

|

Dividend policy |

We currently do not intend to declare any dividends on our common stock in the foreseeable future. Our ability to pay dividends on our common stock may be limited by the terms of any future debt or preferred securities we may issue or any future credit facilities we may enter into. See the section titled “Dividend Policy.” |

|

|

Proposed Nasdaq Capital Market trading symbol |

|

The total number of shares of our common stock that will be outstanding after this offering is based on 30,107,127 shares of common stock outstanding as of September 30, 2022 and excludes:

• 2,901,000 shares of our common stock issuable upon the exercise of options outstanding as of September 30, 2022 under our 2021 Stock Incentive Plan, or the 2021 Plan, at a weighted-average exercise price of $1.91 per share; and

• 5,000,000 shares of common stock reserved for future issuance under our 2022 Equity Incentive Plan, or the 2022 Plan, under which we expect to make all future awards (including awards to our executive officers, directors and consultants of 3,000,000 shares of restricted stock that we anticipate making upon the effectiveness of the registration statement of which this prospectus is a part); and

• 57,250 shares of common stock issuable to Revere Securities LLC as partial compensation for its role as placement agent in connection with an unregistered offering of shares of common stock.

Unless otherwise indicated, this prospectus assumes or gives effect to the following:

• the filing and effectiveness of our amended and restated certificate of incorporation to be effective immediately prior to the closing of this offering, or our Certificate of Incorporation, and the adoption of our amended and restated bylaws to be effective immediately prior to the closing of this offering, or our Bylaws; and

• no exercise by the underwriters of their option to purchase 225,000 additional shares of our common stock.

Summary Consolidated Financial Data

The following tables present our summary consolidated financial data as of and for the period indicated. The statement of operations and comprehensive loss data for the six-month period ended June 30, 2022, and the balance sheet data as of June 30, 2022, are derived from our unaudited financial statements that are included elsewhere in this prospectus.

You should read this data together with our audited consolidated financial statements and related notes, as well as the information under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included elsewhere in this prospectus. The summary financial data in this section are not intended to replace our financial statements and the related notes and are qualified in their entirety by the financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of results that should be expected in any future period.

7

|

For the |

||||

|

Consolidated Statement of Operations Data: |

|

|

||

|

Operating expenses: |

|

|

||

|

Research and development |

|

446,440 |

|

|

|

General and administrative |

|

1,239,772 |

|

|

|

Total operating expenses |

|

1,686,212 |

|

|

|

|

|

|||

|

Other income |

|

|

||

|

Interest income |

|

1,454 |

|

|

|

Total other income |

|

1,454 |

|

|

|

|

|

|||

|

Net loss |

|

(1,684,758 |

) |

|

|

|

|

|||

|

Other comprehensive loss: |

|

|

||

|

Foreign currency translation |

|

125,271 |

|

|

|

Total comprehensive loss |

|

(1,559,487 |

) |

|

|

Net loss per share attributable to common stockholders, basic and diluted |

$ |

(0.06 |

) |

|

|

Weighted average common shares outstanding, basic and diluted |

|

27,898,098 |

|

|

|

As of June 30, |

||||||

|

|

Pro Forma, As |

|||||

|

(unaudited) |

||||||

|

Balance Sheet Data: |

|

|

||||

|

Cash |

$ |

2,813,411 |

$ |

8,320,321 |

||

|

Working capital(3) |

$ |

1,741,235 |

$ |

7,093,735 |

||

|

Total assets |

$ |

10,027,052 |

$ |

15,379,552 |

||

|

Total liabilities |

$ |

2,618,514 |

$ |

2,618,514 |

||

|

Total stockholders’ equity |

$ |

7,408,538 |

$ |

12,761,038 |

||

____________

(1) The pro forma as adjusted column reflects the sale of 1,500,000 shares of our common stock offered in this offering, assuming an initial public offering price of $4.50 per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

(2) A $1.00 increase or decrease in the assumed initial public offering price of $4.50 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease the pro forma as adjusted amount of each of cash, cash equivalents and investments, working capital, total assets and total stockholders’ equity by $1.4 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions. An increase or decrease of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase or decrease the pro forma as adjusted amount of each of cash, cash equivalents and investments, working capital, total assets and total stockholders’ equity by $4.2 million, assuming no change in the assumed initial public offering price per share and after deducting estimated underwriting discounts and commissions. This pro forma as adjusted information is illustrative only and will depend on the actual initial public offering price and other terms of this offering determined at pricing.

(3) We define working capital as current assets less current liabilities. See our consolidated financial statements for further details regarding our current assets and current liabilities. See our financial statements and related notes included elsewhere in this prospectus for further details regarding our current assets and current liabilities.

8

An investment in our common stock involves a high degree of risk. In deciding whether to invest, you should carefully consider the following risk factors, as well as the financial and other information contained in this prospectus, including our consolidated financial statements and related notes. Any of the following risks could have a material adverse effect on our business, financial condition, results of operations or prospects and cause the value of our stock to decline, which could cause you to lose all or part of your investment. Additional risks and uncertainties of which we are unaware, or that we currently deem immaterial also may become important factors that affect us.

Risks Related to Our Limited Operating History, Financial Position and Need For Additional Capital

We have a very limited operating history, and we have incurred losses since our inception and anticipate that we will continue to incur significant losses for the foreseeable future. We may never generate any revenue or become profitable or, if we achieve profitability, we may not be able to sustain it.

We were incorporated in September 2021 and we have a very limited operating history upon which you can evaluate our business and prospects. Our operations to date have been primarily focused on acquiring the assets of Molybdos (after participating in and being declared the winner of a competitive auction process under Section 45 of the South Africa Consumer Protection Act, 2008 for ZAR 11,000,000, which at the then current exchange rate was approximately USD 734,000)) and in-licensing intellectual property rights related to the production of Molybdenum-100 (a non-radioactive isotope we believe may have applications primarily in the medical industry) and Uranium-235 (an isotope of uranium we believe may have application in the clean, efficient and carbon-free energy industry) using the ASP technology, organizing and staffing our company, research and development activities, business planning, raising capital, and providing general and administrative support for these operations. In July 2022, we acquired assets comprising a dormant Silicon-28 aerodynamic separation processing plant from Klydon for ZAR 6,000,000 (which at the then current exchange rate was approximately USD 364,000), which will be payable to Klydon on the later of 180 days of the acquisition and the date on which the assets generate any revenues of any nature. We have not yet built a functioning Mo-100 or U-235 manufacturing plant or even demonstrated the ability to produce Mo-100 or U-235 using the ASP technology. We have not yet demonstrated an ability to overcome many of the risks and uncertainties frequently encountered by companies in the medical, technology and energy industries, including an ability to obtain applicable regulatory approvals, manufacture any isotopes at commercial scale (or arrange for a third party to do so on our behalf), or conduct sales and marketing activities necessary for successful isotope commercialization. In addition, we have not yet sought any regulatory approval that may be necessary for application of Mo-100 that we may develop using the ASP process in the medical industry. Consequently, any predictions about our future performance may not be as accurate as they would be if we had a history of successfully developing and commercializing isotopes.

Investment in isotope enrichment technology is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential isotopes will fail to demonstrate adequate utility or effectiveness in the targeted application (or for medical indications, an acceptable safety profile), gain regulatory approval, if applicable, and become commercially viable. We have no products approved for commercial sale and have not generated any revenue to date, and we continue to incur significant research and development and other expenses related to our ongoing operations. As a result, we are not profitable and have incurred losses since our inception in September 2021. For the period from September 13, 2021 (inception) through December 31, 2021, we reported a net loss of $2.6 million. For the six-month period ended June 30, 2022, we reported a net loss of $1.7 million. As of June 30, 2022, we had an accumulated deficit of $4.3 million.

We expect to continue to incur significant losses for the foreseeable future, and we expect these losses to increase as we:

• continue to invest in our research and development activities;

• seek applicable regulatory approvals for any future isotopes that we may successfully develop;

• experience any delays or encounter any issues with any of the above, including but not limited to failed research and development activities, safety issues or other regulatory challenges, the risk of which in each case may be exacerbated by the ongoing COVID-19 pandemic;

9

• hire additional engineering and production personnel and build our internal resources, including those related to audit, patent, other legal, regulatory and tax-related services associated with maintaining compliance with exchange listing and SEC requirements, director and officer insurance premiums and investor and public relations costs;

• obtain, expand, maintain, enforce and protect our intellectual property portfolio;

• establish a sales, marketing and distribution infrastructure and establish manufacturing capabilities, whether alone or with third parties, to commercialize future isotopes (assuming receipt of applicable regulatory approvals), if any; and

• operate as a public company.

We expect limited commercial activity for Mo-100 in the United States during the next two to three years and we anticipate that most of our initial revenues from future sales of our Mo-100 will be derived from countries in Asia and EMEA (Europe, Middle East and Africa). To become and remain profitable, we must succeed in developing and eventually commercializing isotopes that generate significant revenue. This will require us to be successful in a range of challenging activities, including completing research and development activities relating to our ASP technology, obtaining applicable regulatory approval for future isotopes, if any, and manufacturing, marketing and selling any future isotopes (assuming receipt of applicable regulatory approvals). We are only in the preliminary stages of most of these activities. We may never succeed in these activities and, even if we do, may never generate revenues that are significant enough to achieve profitability. Because of the numerous risks and uncertainties associated with chemical isotopes separation, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our failure to become and remain profitable would depress the value of our company and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our future isotopes or even continue our operations. A decline in the value of our company could also cause you to lose all or part of your investment.

Our future prospects are tied directly to the diagnostic medical imaging industry and depend on our ability to successfully introduce our Mo-100 and adapt to a changing technology and medical practice landscape.

The field of diagnostic medical imaging is dynamic, with new products, including equipment, software and products, continually being developed and existing products continually being refined. New hardware (scanners), software or agents in a given diagnostic modality may be developed that provide benefits superior to the then-dominant hardware, software and agents in that modality, resulting in commercial displacement of the existing radiotracers. For example, alternate scanners and radiotracers could be introduced. Similarly, changing perceptions about comparative efficacy and safety, as well as changing availability of supply may favor one agent over another or one modality over another. In addition, new or revised appropriate use criteria developed by professional societies, to assist physicians and other health care providers in making appropriate imaging decisions for specific clinical conditions, can and have reduced the frequency of and demand for certain imaging modalities and imaging agents. Technological obsolescence in any of the medical imaging products that would use the Mo-100 that we plan to manufacture could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We may not realize the anticipated benefits of previous acquisitions.

The success of the company will depend in large part on the success of our management in integrating the acquired assets into the company. In October 2021, our subsidiary in South Africa acquired the assets of Molybdos after participating in and being declared the winner of a competitive auction process under Section 45 of the South Africa Consumer Protection Act, 2008 for ZAR 11,000,000 (which at the then current exchange rate was approximately USD 734,000), plus value added tax (VAT) levied by the government of South Africa at the rate of 15% and auctioneers’ commission at the rate of 10%. We have not yet built a functioning Mo-100 or U-235 manufacturing plant or even demonstrated the ability to produce Mo-100 or U-235 using the assets acquired at the business rescue auction. We will not know whether the assets that we acquired will work according to our expectations until we have completed construction of the Molybdos plant as contemplated by our turnkey contract with Klydon (see the section of this prospectus entitled “Certain Relationships and Related Party Transactions — Our Relationship with Klydon Proprietary Limited — Turnkey Contract”). In July 2022, we acquired assets comprising a dormant Silicon-28 aerodynamic separation processing plant from Klydon

10

located in Pretoria, South Africa for ZAR 6,000,000 (which at the then current exchange rate was approximately USD 364,000). We intend to explore commercial opportunities for Silicon-28 and other light isotopes that may be produced using these assets. Our failure to achieve the integration of the acquired assets into the company and to commercialize the assets could result in our failure to realize the anticipated benefits of those acquisitions and could impair our results of operations, profitability and financial results.

We currently have no customers or sales, but we expect to be heavily dependent on a few large customers to generate a majority of our revenues for our Mo-100. Our operating results could be adversely affected by a reduction in business with our future significant customers.

We currently have no customers or sales. However, we expect to rely on a limited number of customers outside of the United States to purchase any Mo-100 that we develop using the ASP technology under long-term contracts. Our future key customers may stop ordering our Mo-100 at any time or may become bankrupt or otherwise unable to pay. The loss of any of our future key customers could result in lower revenues than we anticipate and could harm our business, financial condition or results of operations.

Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.”

We incurred a net loss of $2.6 million for the period from September 13, 2021 (inception) through December 31, 2021 and a net loss of $1.7 million for the six-month period ended June 30, 2022. As of June 30, 2022, we had approximately $2.8 million in cash. We have yet to generate any revenues and we anticipate that our losses will continue for the foreseeable future. We cannot assure you that our plans to commercialize isotopes that we may develop will be successful. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The financial statements contained elsewhere in this report do not include any adjustments that might result from our inability to continue as a going concern. Unless we can begin to generate material revenue, we may not be able to remain in business. We cannot assure you that we will raise enough money or generate sufficient sales to meet our future working capital needs.

Even if this offering is successful, we will require substantial additional capital to finance our operations, which may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development efforts or other operations.

We expect our expenses to increase substantially in connection with our ongoing and planned activities, particularly as we continue our research and development activities, seek applicable regulatory approvals for any future isotopes that we may successfully develop, and expand our organization by hiring additional personnel. In addition, following the closing of this offering, we expect to incur additional costs associated with operating as a public company.

As of June 30, 2022, our cash was approximately $2.8 million. We believe, based on our current operating plan, that the net proceeds from this offering, together with our existing cash and cash equivalents, will be sufficient to fund our operations for at least the next 12 months after the closing of the offering. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings, third-party funding, marketing and distribution arrangements, as well as other collaborations, strategic alliances and licensing arrangements, or any combination of these approaches.

In any event, we will require substantial additional capital to support our business operations as we pursue additional research and development activities related to our ASP technology and seek applicable regulatory approval of our any future isotopes, and otherwise to support our continuing operations. In addition, we expect to incur significant commercialization expenses related to product sales, marketing, manufacturing and distribution (assuming receipt of applicable regulatory approvals for our future isotopes). Even if we believe we have sufficient capital for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations. Any additional capital raising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our future isotopes (assuming receipt of applicable regulatory approvals).

11

Additional funding may not be available on acceptable terms, or at all. We have agreed to pay the underwriter of this offering “tail compensation” equal to 8.0% of the aggregate gross proceeds received by us from the sale of our common stock in any private or public offering or other financing or capital-raising transaction of any kind within the 12 month period following the effective date of the registration statement of which this prospectus is a part. As a result of the COVID-19 pandemic and actions taken to slow its spread, the global credit and financial markets have experienced extreme volatility and disruptions, including severely diminished liquidity and credit availability. If the equity and credit markets deteriorate, it may make any necessary debt or equity financing more difficult, more costly or more dilutive. If we do not raise additional capital in sufficient amounts, we may be prevented from pursuing development and commercialization efforts, which will harm our business, operating results and prospects.

Raising additional capital or acquiring or licensing assets by issuing equity or debt securities may cause dilution to our stockholders, and raising funds through lending and licensing arrangements may restrict our operations or require us to relinquish proprietary rights.

We may seek additional capital through a combination of public and private equity offerings, debt financings, strategic partnerships and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. The incurrence of indebtedness would result in increased fixed payment obligations and could involve certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional capital through future collaborations, strategic alliances or third-party licensing arrangements, we may have to relinquish valuable rights to our intellectual property, future revenue streams, research programs or future isotopes, or grant licenses on terms that may not be favorable to us.

If we are unable to raise additional capital when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts, or grant rights to develop and market our future isotopes (assuming receipt of applicable regulatory approvals for our future isotopes) that we would otherwise develop and market ourselves.

Risks Related to the Development and Commercialization of Our Future Isotopes

We are early in our research and development efforts for Mo-100 and U-235 using the ASP technology. If we are unable to advance our future isotopes in development, obtain applicable regulatory approval and ultimately commercialize our future isotopes, or experience significant delays in doing so, our business will be materially harmed.

We are early in our research and development efforts and currently have only Mo-100, a non-radioactive isotope we believe may have applications primarily in the medical industry (for use by radiopharmacies, hospitals, clinics and others in the medical community to prepare various nuclear imaging agents), in development using the ASP technology. We initiated the initial proof of concept stage (Phase 1) of the Mo-100 development plan in October 2021 and while we expect to complete the proof of concept stage during the second half of 2022, it is possible that the proof of concept stage will take longer than anticipated to complete due to unexpected delays.

We also plan to begin enrichment of uranium, which is a chemical element we believe may have application in the clean, efficient and carbon-free energy industry, using the ASP technology. We are in the planning stage of research and development activities for enriched uranium. If we are unable to advance our future isotopes in development, obtain applicable regulatory approval and ultimately commercialize our future isotopes (assuming receipt of applicable regulatory approvals), or experience significant delays in doing so, our business will be materially harmed.

Our ability to generate product revenues will depend heavily on the success of our research and development activities, receipt of applicable regulatory approvals, and eventual commercialization of our future isotopes (assuming receipt of applicable regulatory approvals and compliance with all applicable regulatory authorities).

The success of our business, including our ability to finance our company and generate any revenue in the future, will primarily depend on the successful development, regulatory approval and commercialization of our currently planned future isotopes, Mo-100 and enriched uranium, which may never occur.

12

We will have to be successful in a range of challenging activities, including completing research and development activities relating to our ASP technology, obtaining applicable regulatory approval for future isotopes, if any, and manufacturing, marketing and selling any future isotopes (assuming receipt of applicable regulatory approvals). We are only in the preliminary stages of most of these activities. If we are unable to succeed in these activities, we may not be able to generate sufficient revenue to continue our business.

We rely on a limited number of suppliers to provide us components and a material interruption in supply could prevent or limit our ability to execute our strategic plan and development programs in the expected timeframe.

We depend upon a limited number of third-party suppliers located for certain components required to construct the centrifuges and other equipment for the enrichment plant that is being constructed in South Africa. To date, we have been able to obtain the required components for our centrifuges without any significant delays or interruptions, except for certain delays related to COVID-19. If we lose any of these suppliers, we may be required to find and enter into supply arrangements with one or more replacement suppliers. Obtaining alternative sources of supply could involve significant delays and other costs and these supply sources may not be available to us on reasonable terms or at all. Any disruption of supplies could delay completion of the enrichment plant in South Africa, which could adversely affect our ability to execute our strategic plan and development programs in the expected timeframe.

Our business, financial and operating performance could be adversely affected by epidemics and other health related issues including but not limited to the coronavirus disease 2019 (“COVID-19”) pandemic.

The global outbreak of COVID-19 has negatively affected global economies, disrupted supply chains, and has resulted in significant travel, transport, and other restrictions. The COVID-19 outbreak has disrupted the supply chains and day-to-day our operations (and the operations of our suppliers and contractors (including Klydon), which could materially adversely affect our operations). In this regard, global supply chains and the timely availability of components imported to South Africa from the United States, countries in Europe or other nations could be materially disrupted by quarantines, slowdowns or shutdowns, border closings, and travel restrictions resulting from the global COVID-19 pandemic or other global pandemic or health crises. Further, impacts of COVID-19 infections and other COVID-19 pandemic related impacts on our management and workforce, or our suppliers and contractors (including Klydon), could adversely impact our business. While we have taken steps to protect our workforce and carry on operations, we may not be able to mitigate all of the potential impacts. We anticipate increased costs related to, or resulting from, the COVID-19 pandemic, due to, among other things, delays in supplier deliveries, impacts of travel restrictions, site access and quarantine requirements.

In the event that the COVID-19 pandemic prevents our employees or our contractors from working in-person at our facility in South Africa or our suppliers are unable to provide goods and services on the schedule we anticipated, the impacts on our schedule and costs could be material. The ultimate impact of the COVID-19 pandemic on our operations, including our ability to execute our strategic plan and development programs in the expected timeframe, remains uncertain and will depend on future pandemic-related developments, including the duration of the pandemic and any potential subsequent variants of COVID-19 and related government actions to prevent and manage disease spread, all of which are uncertain and cannot be predicted. The long-term impacts of the COVID-19 pandemic on us, our contractors and suppliers that could impact our business are also difficult to predict but could adversely affect our business, results of operations, and prospects.

Development activities at our facility in South Africa could be disrupted for a variety of reasons, which could prevent us from completing our development activities.

A disruption in development activities at our facility in South Africa could have a material adverse effect on our business. Disruptions could occur for many reasons, including power outages, fire, natural disasters, weather, unplanned maintenance or other manufacturing problems, public health crises (including, but not limited to, the COVID-19 pandemic), disease, strikes or other labor unrest, transportation interruption, government regulation, political unrest or terrorism. Alternative facilities with sufficient capacity or capabilities may not be available, may cost substantially more or may take a significant time to start production, each of which could negatively affect our business and financial performance.

13

Risks associated with the in-licensing of the ASP technology for development of Mo-100 or enriched uranium could cause substantial delays in the development of our future isotopes.

Prior to October 2021, as a company we had no involvement with or control over the research and development of the ASP technology. We have relied and continue to rely on Klydon to conduct such research and development in accordance with the applicable legal, regulatory and scientific standards prior to the in-licensing of the ASP technology for development of Mo-100 or U-235. If the research and development processes or the results of the development programs prior to the in-licensing of the ASP technology for development of Mo-100 or U-235 prove to be unreliable, this could result in increased costs and delays in the development of our future isotopes, which could adversely affect any future revenue from these future isotopes (assuming receipt of applicable regulatory approvals).

Regulatory approval for production and distribution of radiopharmaceuticals used for medical imaging and therapeutic treatments may involve a lengthy and expensive process with an uncertain outcome.

Currently, the sale or use of Mo-100 is not regulated by a healthcare regulator, such as the FDA, European Medicines Agency (EMA) or comparable foreign regulatory authorities. However, products such as Mo-99 and Tc-99m that are produced from Mo-100 in a cyclotron or a linear accelerator are regulated by healthcare regulators. We expect radiopharmacies, hospitals, clinics and others in the medical community to produce the widely used medical radioisotope technetium-99m (Tc-99m) from the Mo-100 that we may produce using our ASP technology. Tc-99m is a diagnostic agent that is used by health care professionals with FDA-approved imaging devices to detect potential diseases like coronary artery disease and cancer, as well as evaluating lung, liver, kidney and brain function. When used with the appropriate diagnostic scanner device, such as a SPECT imaging system, the Tc-99m emits signals that are captured and produces an image of internal organs to detect various medical problems and contribute to diagnosis and treatment decisions. Our future customers who may use Mo-100 to produce radiopharmaceuticals will likely require regulatory approval for their products. To date, only one healthcare regulator (Canada) has approved the use of Tc-99m produced from Mo-100 via a cyclotron. Obtaining regulatory approval is expensive and can take many years to complete, and its outcome is inherently uncertain. Our customers’ regulatory approval process may not be conducted as planned or completed on schedule, if at all, and failure can occur at any time during the process.

In the future, we may need to obtain approval from the FDA, EMA or comparable foreign regulatory authorities prior to the sale of Mo-100 that we may produce using our ASP technology for use in medical imaging and therapeutic treatments. If we require FDA, EMA or other comparable foreign regulatory authorities to approve the sale of Mo-100 that we may produce using our ASP technology for medical imaging and therapeutic treatments, we must demonstrate the safety and utility or efficacy of our Mo-100. Obtaining regulatory approval is expensive and can take many years to complete, and its outcome is inherently uncertain. Our regulatory approval process may not be conducted as planned or completed on schedule, if at all, and failure can occur at any time during the process.

Our success depends on our future customers’ ability to successfully commercialize products that are produced from our isotopes.

Our customers operate in a competitive environment. If our customers are unable to successfully commercialize products that they produce from our isotopes, our business will be negatively impacted. Our customers may fail for a number of reasons including but not limited to pricing pressure from competing products and failure to gain regulatory approval for the production of their products from healthcare regulators.

Our success depends on our ability to adapt to a rapidly changing competitive environment in the nuclear industry.

The nuclear industry in general, and the nuclear fuel industry in particular, is in a period of significant change, which could significantly transform the competitive landscape we face. The uranium and isotope enrichment sector is competitive. Changes in the competitive landscape may adversely affect pricing trends, change customer spending patterns, or create uncertainty. To address these changes, we may seek to adjust our cost structure and efficiency of operations and evaluate opportunities to grow our business organically or through acquisitions and other strategic transactions. We are actively considering, and expect to consider from time to time in the future, potential strategic transactions, which could involve, without limitation, changes in our capital structure, acquisitions and/or dispositions of businesses or assets, joint ventures or investments in businesses, products or technologies.

14

In connection with any such transaction, we may seek additional debt or equity financing, contribute or dispose of assets, assume additional indebtedness, or partner with other parties to consummate a transaction. Any such transaction may not result in the intended benefits and could involve significant commitments of our financial and other resources. Legal and consulting costs incurred in connection with debt or equity financing transactions in development are deferred and subject to immediate expensing if such a transaction becomes less likely to occur. If the actions we take in response to industry changes are not successful, our business, results of operations and financial condition may be adversely affected.

We may explore strategic collaborations that may never materialize or may fail.

We intend to accelerate the development of our enriched uranium program by selectively collaborating with energy companies in the United States. We intend to retain significant technology, economic and commercial rights to our programs in key geographic areas that are core to our long-term strategy. As a result, we intend to periodically explore a variety of possible additional strategic collaborations in an effort to gain access to additional resources. At the current time, we cannot predict what form such a strategic collaboration might take. We are likely to face significant competition in seeking appropriate strategic collaborators, and strategic collaborations can be complicated and time consuming to negotiate and document. We may not be able to negotiate strategic collaborations on acceptable terms, or at all. We are unable to predict when, if ever, we will enter into any additional strategic collaborations because of the numerous risks and uncertainties associated with establishing them.

If the market opportunities for our future isotopes are smaller than we estimate (even assuming receipt of any required regulatory approval), our business may suffer.

We are currently focused on producing Mo-100 using our ASP technology to meet critical patient healthcare needs and advance clinical research. We also plan to produce enriched uranium to meet the future needs of developers of U.S. advanced reactor technologies requiring HALEU. Our projections of the potential markets are based on estimates that have been derived from a variety of sources, including scientific literature and market research, and which may prove to be incorrect. We must be able to successfully acquire a significant market share in our potential markets to achieve profitability and growth. Customers may become difficult to gain access to, which would adversely affect our results of operations and our business.

We face substantial competition, which may result in others discovering, developing or commercializing isotopes before or more successfully than us.

The development and commercialization of radioisotopes and chemical elements is highly competitive. We face competition with respect to Mo-100 that we may produce using our ASP technology from established biotechnology and nuclear medicine technology companies and will face competition with respect to enriched uranium that we may seek to develop or commercialize in the future from innovative technology and energy companies. There are a number of large biotechnology and nuclear medicine technology companies that currently market and sell radioisotopes to radiopharmacies, hospitals, clinics and others in the medical community (Mo-99 is the active ingredient for Tc-99m-based radiopharmaceuticals used in nuclear medicine procedures). There are also a number of technology and energy companies that are currently seeking to develop HALEU. Potential competitors also include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization.

More established companies may have a competitive advantage over us due to their greater size, resources and institutional experience. In particular, these companies have greater experience and expertise in securing reimbursement, government contracts, relationships with key opinion leaders, obtaining and maintaining regulatory approvals and distribution relationships to market products. These companies also have significantly greater research and marketing capabilities than we do. If we are not able to compete effectively against existing and potential competitors, our business and financial condition may be harmed.

As a result of these factors, our competitors may complete development of isotopes before we are able to, which may limit our ability to develop or commercialize our future isotopes. Our competitors may also develop radioisotopes or technologies that are safer, more effective, more widely accepted and cheaper than ours, and may

15

also be more successful than us in manufacturing and marketing their isotopes. These appreciable advantages could render our future isotopes obsolete or non-competitive before we can recover the expenses of their development and commercialization.

Mergers and acquisitions in the technology and energy industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller and other early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These third parties compete with us in recruiting and retaining qualified scientific, management and commercial personnel, as well as in acquiring technologies complementary to, or necessary for, our programs.