UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ASP Isotopes Inc. |

| (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1101 Pennsylvania Avenue NW, Suite 300

Washington, DC 20004

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

Dear Stockholder:

The Annual Meeting of Stockholders (the “Annual Meeting”) of ASP Isotopes Inc. (the “Company”) will be held on Monday, December 4, 2023, at 10:00 a.m., Eastern time. The Annual Meeting will be held in a virtual format via live webcast over the internet. You will be able to join the Annual Meeting and vote and submit your questions online during the Annual Meeting by visiting https://web.lumiagm.com/253072518. We have designed the virtual Annual Meeting to ensure that stockholders are afforded the same opportunity to participate as they would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform. Reference to “in person” attendance or voting in our proxy materials refers, therefore, to attending or voting at the Annual Meeting virtually.

The Annual Meeting will take place for the following purposes:

|

| 1. | To elect two directors to serve as Class I directors for a three-year term to expire at the 2026 annual meeting of stockholders; |

|

|

|

|

|

| 2. | To consider and vote upon the ratification of the selection of EisnerAmper LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

|

|

|

|

|

| 3. | To transact such other business as may be properly brought before the annual meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the attached proxy statement, which forms a part of this notice and is incorporated herein by reference. Our board of directors has fixed the close of business on October 23, 2023 as the Record Date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

Your vote is important. Whether or not you expect to attend the Annual Meeting, we encourage you to read the proxy statement accompanying this notice and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions in the section entitled “General Information About the Annual Meeting and Voting” beginning on page 1 of the proxy statement accompanying this notice. If you plan to attend our Annual Meeting and wish to vote your shares at the meeting, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to attend the meeting.

|

| By Order of the Board of Directors, |

|

|

|

|

|

|

| Paul E. Mann |

|

|

| Chair of the Board |

|

Washington, DC

November 1, 2023

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible.

This notice of annual meeting and proxy statement and form of proxy are first being distributed on or about November 3, 2023. The proxy materials and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 can be accessed as of November 3, 2023 by visiting http://www.astproxyportal.com/ast/27081.

| i |

| Table of Contents |

|

|

| Page |

|

|

|

|

|

|

|

| 1 |

| |

|

|

|

|

|

|

| 6 |

| |

|

|

|

|

|

|

| 14 |

| |

|

|

|

|

|

| PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 15 |

|

|

|

|

|

|

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 17 |

|

|

|

|

|

|

|

| 19 |

| |

|

|

|

|

|

|

| 20 |

| |

|

|

|

|

|

|

| 27 |

| |

|

|

|

|

|

|

| 30 |

| |

|

|

|

|

|

|

| 31 |

| |

|

|

|

|

|

|

| 31 |

| |

|

|

|

|

|

|

| 31 |

|

| ii |

| Table of Contents |

1101 Pennsylvania Avenue NW, Suite 300

Washington, DC 20004

PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On Monday, December 4, 2023

The board of directors of ASP Isotopes Inc. (the “Company” or “ASPI”) is soliciting proxies for use at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Monday, December 4, 2023, at 10:00 a.m., Eastern time, and any postponements or adjournments thereof. The Annual Meeting will be held in a virtual format only, via live webcast over the internet. You will be able to join the Annual Meeting and vote and submit your questions online during the Annual Meeting by visiting https://web.lumiagm.com/253072518. We have designed the virtual Annual Meeting to ensure that stockholders are afforded the same opportunity to participate as they would have at an in-person meeting, including the right to vote and ask questions through the virtual meeting platform. Reference to “in person” attendance or voting in our proxy materials refers, therefore, to attending or voting at the Annual Meeting virtually.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive these proxy materials?

We have furnished these proxy materials to you because our board of directors is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes information related to your vote at the Annual Meeting. All stockholders who find it convenient to do so are cordially invited to attend the Annual Meeting. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete and submit your proxy via phone or the Internet in accordance with the instructions provided on the Notice, or, if you requested a printed copy of the proxy materials, complete, sign and return the proxy card.

We intend to begin mailing our proxy materials and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”) on or about November 3, 2023 to all stockholders of record as of October 23, 2023 (the “Record Date”). Our 2023 proxy materials and our 2022 Annual Report are also accessible at: http://www.astproxyportal.com/ast/27081. Only stockholders who owned our common stock on the Record Date are entitled to vote at the Annual Meeting. On the Record Date, there were 38,448,184 shares of our common stock outstanding. Common stock is our only class of stock entitled to vote.

Why is the meeting being held virtually this year?

We believe that a virtual meeting will provide expanded stockholder access and participation, as well as improved communications. You will be able to join the Annual Meeting and vote and submit questions online during the Annual Meeting by visiting https://web.lumiagm.com/253072518 and using the 11-digit control number included on your proxy card or on your vote instruction form provided by your broker, bank or other nominee. Online check-in will be available at the virtual meeting site approximately 15 minutes prior to the beginning of the Annual Meeting.

| 1 |

| Table of Contents |

What am I voting on?

There are two proposals scheduled for a vote:

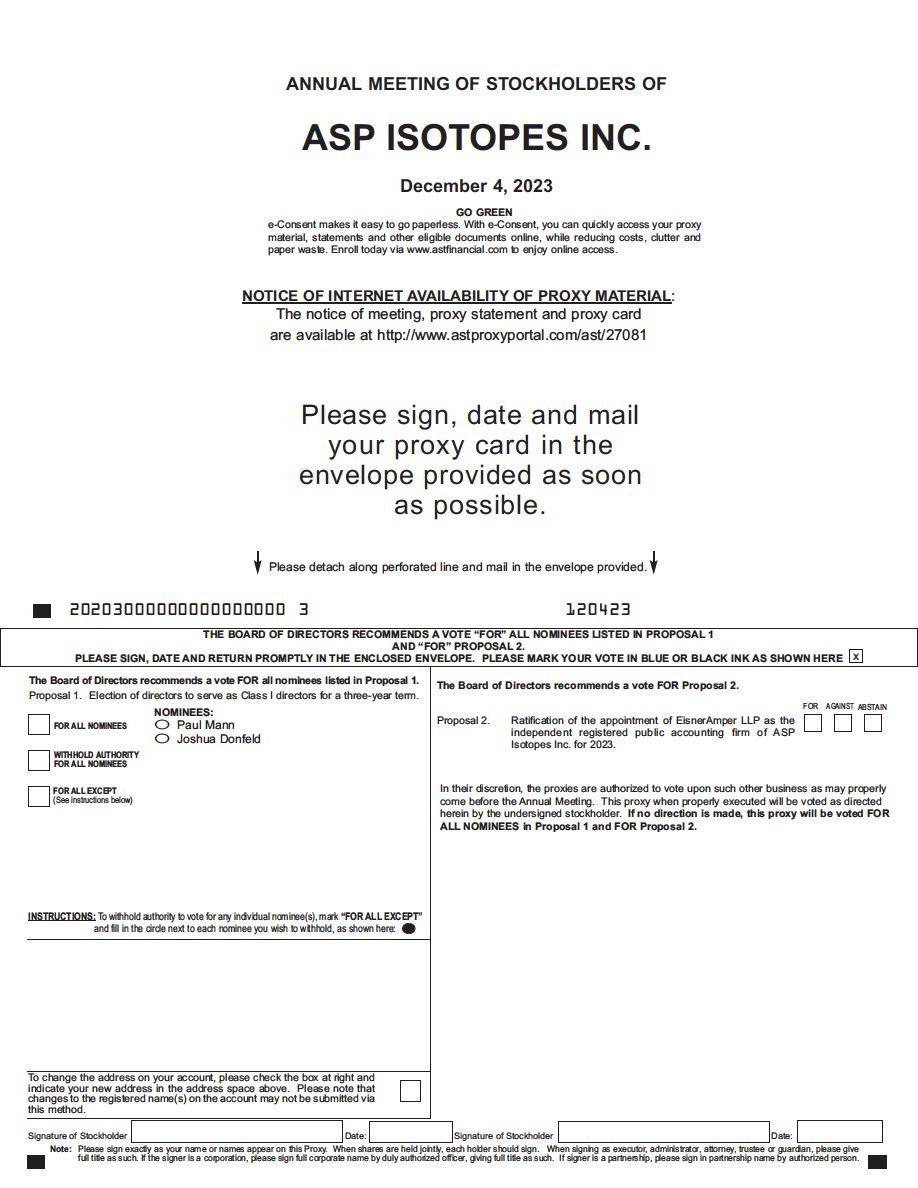

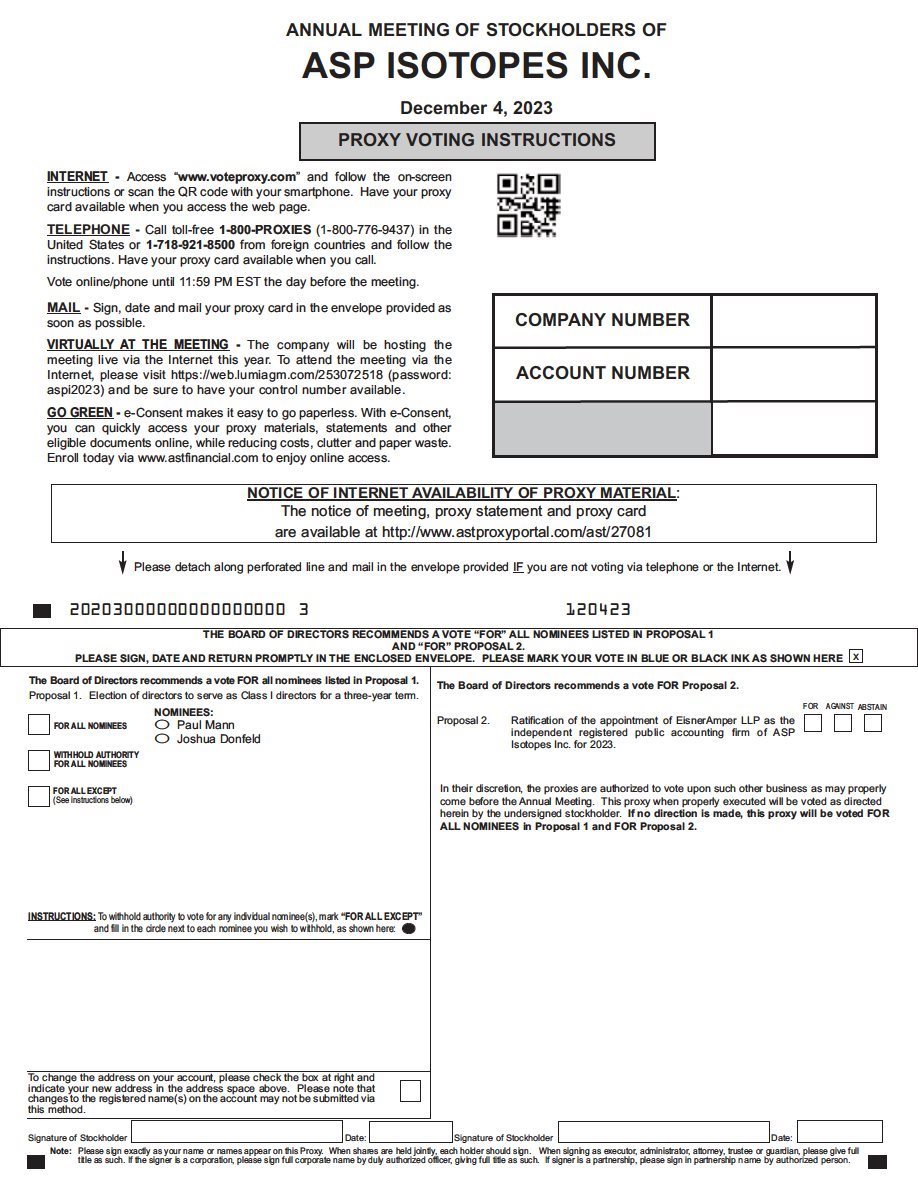

Proposal 1: To elect two directors to serve as Class I directors for a three-year term.

Proposal 2: To consider and vote upon the ratification of the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2023.

How many votes do I have?

Each share of our common stock that you own as of October 23, 2023, entitles you to one vote.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

If your shares are registered directly in your name with our registrar and transfer agent, Equiniti Trust Company, LLC (“Equiniti”) (formerly American Stock Transfer & Trust Company, LLC), you are considered a stockholder of record with respect to those shares and our proxy materials have been made available to you directly by us. If your shares are held in a stock brokerage account, by a bank, broker, or other agent, you are considered the beneficial owner of shares held in street name and our proxy materials are being forwarded to you by your bank, broker, or other agent that is considered the owner of record of those shares. As the beneficial owner, you have the right to instruct your bank, broker, or other agent on how to vote your shares. Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the meeting. If you are a beneficial owner and do not wish to vote in person or you will not be attending the Annual Meeting, you may vote by following the instructions provided by your broker, bank, trustee, or other nominee.

How do I vote by proxy?

With respect to the election of Class I directors, you may either vote “For” or you may “Withhold” your vote for any nominee you specify. With respect to the ratification of the appointment of EisnerAmper LLP as our independent registered public accounting firm, you may vote “For” or “Against” or abstain from voting.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure that your vote is counted.

|

| · | Via the Internet: You may vote at https://web.lumiagm.com/253072518, 24 hours a day, seven days a week by following the Internet voting instructions on your Notice. |

|

|

|

|

|

| · | By Telephone: You may vote using a touch-tone telephone by calling 1-800-776-9437, 24 hours a day, seven days a week by following the telephone voting instructions on your Notice. |

|

|

|

|

|

| · | At the Meeting: To vote by “virtually” attending the Annual Meeting by accessing https://web.lumiagm.com/253072518 and selecting the button “I have a Control Number.” You will then be directed to a screen where you will enter: (1) the 11-digit control number on the proxy card; and (2) the meeting password “aspi2023”. Please note the meeting password is case sensitive. Once you have completed these steps, select the “login” button, which will take you to the annual meeting page (“Meeting Page”) where you can vote, submit written questions and listen to the meeting. If you are a stockholder of record and misplaced your 11-digit control number, please call Equiniti at (800) 937-5449. |

|

|

|

|

|

| · | By Mail, if You Requested a Printed Copy of Your Proxy Materials: You may vote using your proxy card by completing, signing, dating and returning the proxy card in the self-addressed, postage-paid envelope provided. If you properly complete your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your shares, as permitted, will be voted as recommended by our board of directors. If any other matter is presented at the Annual Meeting, your proxy will vote in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the meeting, other than those discussed in this proxy statement. |

| 2 |

| Table of Contents |

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, and requested a printed copy of the proxy materials, you should have received a voting instruction form and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the voting instruction form to ensure that your vote is counted. You may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If you are a beneficial owner, to vote by “virtually” attending the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact that organization to request a proxy form.

May I revoke my proxy?

If you are a stockholder of record, if you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the three following ways:

|

| · | you may grant a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method); |

|

|

|

|

|

| · | you may notify our corporate secretary in writing before the Annual Meeting that you have revoked your proxy by mailing a written notice of revocation to the attention of Corporate Secretary, ASP Isotopes Inc., 1101 Pennsylvania Avenue NW, Suite 300, Washington, DC 20004; or |

|

|

|

|

|

| · | you may vote in person at the Annual Meeting; however, your virtual attendance at the Annual Meeting alone will not revoke your proxy. |

If you own your shares in street name, you may change your vote by submitting new voting instructions to your broker, bank, trustee, or nominee following the instructions they provided or, if you have obtained a legal proxy from your broker, bank, trustee, or nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person at the meeting.

Can I attend and vote at the virtual meeting?

Record Holders: If you were a stockholder of record as of the close of business on October 23, 2023 (i.e., you held your shares in your own name as reflected in the records of our transfer agent, Equiniti Trust Company, LLC (“Equiniti”) (formerly American Stock Transfer & Trust Company, LLC)), you can attend the annual meeting by accessing https://web.lumiagm.com/253072518 and selecting the button “I have a Control Number.” You will then be directed to a screen where you will enter: (1) the 11-digit control number on the proxy card; and (2) the meeting password “aspi2023”. Please note the meeting password is case sensitive. Once you have completed these steps, select the “login” button, which will take you to the annual meeting page (“Meeting Page”) where you can vote, submit written questions and listen to the meeting. If you are a stockholder of record and misplaced your 11-digit control number, please call Equiniti at (800) 937-5449.

Beneficial Owners: If you were a beneficial owner as of the close of business on October 23, 2023 (i.e., you hold your shares in “street name” through an intermediary, such as a bank, broker or other nominee), you must register in advance to attend the annual meeting. To register, please obtain a legal proxy from the bank, broker or other nominee that is the record holder of your shares and then submit the legal proxy, along with your name and email address, to Equiniti to receive an 11-digit control number that may be used to access the annual meeting site provided above. Any control number that was provided with your proxy materials, likely a 16-digit number, will not provide access to the annual meeting site. Requests for registration and submission of legal proxies should be labeled as “Legal Proxy” and must be received by Equiniti no later than 5 p.m., ET, on May 10, 2023. All such requests should be submitted (1) by email to proxy@equiniti.com, (2) by facsimile to (718) 765-8730, or (3) by mail to Equiniti Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Obtaining a legal proxy may take several days and stockholders are advised to register as far in advance as possible. Once you have obtained your 11-digit control number from Equiniti, please follow the steps set forth above for “Record Holders” to attend the annual meeting.

| 3 |

| Table of Contents |

Attending as a Guest: If you are a record holder or beneficial owner and would like to enter the annual meeting as a guest in listen-only mode, go to https://web.lumiagm.com/253072518 and select the button “I am a guest.” Please note you will not have the ability to ask questions or vote during the meeting if you participate as a guest.

Record holders and beneficial owners should call Equiniti at (800) 937-5449 with any questions about attending the annual meeting. If you encounter any difficulty accessing the annual meeting, please visit https://go.lumiglobal.com/faq for assistance.

Asking Questions: If you are attending the annual meeting as a stockholder of record or beneficial owner who has registered for the meeting, you can ask questions by clicking the messaging icon on the right side of the toolbar appearing at the top of the Meeting Page and then typing and submitting your question.

Voting Shares: If you are attending the annual meeting as a stockholder of record or beneficial owner who has registered for the meeting, you can vote during the meeting by clicking the link “Proxy Voting Site” on the Meeting Page and following the prompts.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of holders representing a majority of our outstanding common stock as of October 23, 2023, or approximately 19,224,093 shares, constitutes a quorum at the meeting, permitting us to conduct our business.

What vote is required to approve each proposal?

Proposal 1: Election of Class I Directors. The two nominees who receive the most “For” votes (among votes properly cast in person or by proxy) will be elected.

Proposal 2: Ratification of Independent Registered Public Accounting Firm. The ratification of the appointment of EisnerAmper LLP must receive “For” votes from a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote.

Voting results will be tabulated and certified by the inspector of election appointed for the Annual Meeting.

How will my shares be voted if I do not specify how they should be voted?

If you are a stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by our board of directors, then your shares will be voted at the Annual Meeting in accordance with our board of directors’s recommendation on all matters presented for a vote at the Annual Meeting. Similarly, if you requested a printed copy of the proxy materials and sign and return a proxy card but do not indicate how you want to vote your shares for a particular proposal or for all of the proposals, then for any proposal for which you do not so indicate, your shares will be voted in accordance with our board of director’s recommendation.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, the organization that holds your shares may generally vote your shares in their discretion on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.”

| 4 |

| Table of Contents |

What is the effect of withheld votes, abstentions and broker non-votes?

Shares of common stock held by persons attending the Annual Meeting, but not voting, and shares represented by proxies that reflect withheld votes or abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum. For purposes of determining whether our stockholders have ratified the appointment of EisnerAmper LLP, our independent registered public accounting firm, abstentions will have the same effect as a vote “against” this proposal. With regard to the election of directors, because under our amended and restated bylaws and applicable state law, election is determined by a plurality of votes cast, withheld votes or abstentions will not be counted in determining the outcome of such proposal.

Shares represented by proxies that reflect a broker non-vote will be counted for purposes of determining whether a quorum exists. As discussed above, a broker non-vote occurs when an organization holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. With regard to the election of directors, which is considered a non-routine matter, broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. However, ratification of the appointment of EisnerAmper LLP is considered a routine matter on which a broker or other nominee has discretionary authority to vote. Accordingly, no broker non-votes will likely result from this proposal.

What if I need assistance with voting or have technical problems regarding the Annual Meeting?

If you have technical difficulties accessing or using the virtual meeting site during the Annual Meeting, you should call the technical support number on the virtual meeting site. The virtual meeting site is supported on browsers (e.g., Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plug-ins. Each participant should ensure strong Wi-Fi or other internet connection.

Who is paying the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies.

How do I obtain the 2022 Annual Report?

If you would like a copy of our 2022 Annual Report, we will send you one without charge. Please write to:

ASP Isotopes Inc.

1101 Pennsylvania Avenue NW, Suite 300

Washington, DC 20004

Attn: Corporate Secretary

All of our SEC filings are also available free of charge in the “Investor Relations-SEC Filings” section of our website at www.aspisotopes.com.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in our current report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

| 5 |

| Table of Contents |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our board of directors, which is currently comprised of six members, four of whom are “independent” under the listing standards of the Nasdaq Stock Market LLC (“Nasdaq”). The board of directors is nominating two nominees for election. Our board of directors is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring. There are two Class I directors whose current term of office expires at the Annual Meeting: Paul Mann and Joshua Donfeld. Our board of directors has nominated Paul Mann and Joshua Donfeld for re-election at the Annual Meeting to serve as Class I directors until the 2026 annual meeting of stockholders or until their successors are duly elected and qualified.

The following table sets forth the names, ages as of October 23, 2023, and certain other information for each of the directors whose terms expire at the Annual Meeting and for each of the directors whose terms do not expire at the Annual Meeting.

|

Name |

|

Class |

|

Age |

|

Position |

|

Director Since |

|

Current Term Expires |

|

Expiration of Term For Which Nominated |

|

| Nominees for Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Paul Mann |

| I |

| 47 |

| President, Chief Executive Officer and Director |

| 2021 |

| 2023 |

| 2026 |

|

| Joshua Donfeld (1)(2) |

| I |

| 47 |

| Director |

| 2021 |

| 2023 |

| 2026 |

|

| Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Michael Gorley, Ph.D. (2) |

| II |

| 36 |

| Director |

| 2023 |

| 2024 |

| — |

|

| Duncan Moore, Ph.D. (1)(2)(3)(4) |

| II |

| 64 |

| Director |

| 2021 |

| 2024 |

| — |

|

| Hendrik Strydom, Ph.D. |

| III |

| 63 |

| Director |

| 2021 |

| 2025 |

| — |

|

| Todd Wider, M.D.(1)(3) |

| III |

| 58 |

| Director |

| 2021 |

| 2025 |

| — |

|

| (1) | Member of our audit committee |

| (2) | Member of our nominating and corporate governance committee |

| (3) | Member of our compensation committee |

| (4) | Member of our special projects committee |

| 6 |

| Table of Contents |

Nominees for Director

Paul E. Mann co-founded our company in September 2021 and has served as our Chairman and Chief Executive Officer and a member of our board of directors since incorporation. Paul also served as our Chief Financial Officer until September 2022. Prior to ASPI, Paul was Chief Financial Officer of PolarityTE, Inc. (Nasdaq: PTE), a biotechnology company, from June 2018 until April 2020. Prior to that, he responsible for Healthcare investments at DSAM Partners LLC, a global hedge fund. Earlier in his career, he was a portfolio manager at Highbridge Capital where he managed investments in healthcare and biotechnology. Prior to Highbridge Capital, from August 2013 to March 2016, he worked at Soros Fund Management where he was responsible for billions of dollars of investments in healthcare and chemicals companies. During his career as a healthcare and chemicals investor, Paul has helped create and fund numerous early stage and start-up companies. Prior to moving to the buy-side, Paul spent 11 years as a sell-side analyst at Morgan Stanley and Deutsche Bank. He co-managed the healthcare research team at Morgan Stanley, one of the top ranked teams in Institutional Investor, Greenwich and Reuters. He was also corporate broker to over half the UK Pharmaceutical Companies. Paul started his career as a research scientist at Procter and Gamble and he is named as the inventor of numerous skin creams in the Oil of Olay range of cosmetics. He is also a nonexecutive, independent director at Abeona Therapeutics (NASDAQ: ABEO), where he is the chair of the audit committee, and a director at Healthtech Solution Inc. (OTC: HLTT), where he is chairman of the board and serves on the audit committee. He is the co-founder and Chairman of Varian Biopharma, a private biotechnology company focused on precision oncology. Paul has an MA (Cantab) and an MEng from Cambridge University, UK where he studied Natural Sciences and Chemical Engineering and he is a CFA charter holder.

We believe Mr. Mann’s detailed knowledge and unique perspective and insights as our founder and Chief Executive Officer, as well as his prior experience as Chief Financial Officer of another public company and extensive experience managing investments in healthcare, biotechnology and chemicals companies, qualify him to serve on our board of directors and position him well to serve as our Chairman.

Joshua Donfeld has served on our board of directors since October 2021. Joshua was most recently (May 2016-October 2020) a co-founding and co-managing partner of Castle Hook Partners, a New York-based investment management fund. At Castle Hook, among other responsibilities, he was responsible for overseeing the fund’s equity investments in sectors such as healthcare and natural resources. Prior to Castle Hook, Mr. Donfeld was a portfolio manager at Soros Fund Management from May 2012-April 2016. At Soros he was responsible for managing a portfolio of assets across public and private investments in industries spanning Energy, Utilities, Materials, Industrials, Healthcare, Consumer, Infrastructure and Technology. Prior to Soros Joshua was a Managing Director at Canyon Partners in Los Angeles where he was responsible for the firm’s Energy and Utilities investments in credit, distressed and equities. Mr. Donfeld has extensive experience in early-stage investing and he has extensive experience in capital markets, capital structuring, business planning, strategic planning, Wall Street management, corporate finance and accounting. Mr. Donfeld graduated Magna Cum Laude from Princeton University with a BA in Economics and a focus on Chinese language/East Asian Studies.

The Board believes that Mr. Donfeld’s significant financial expertise and experience contribute to the Board’s understanding and ability to analyze complex issues, particularly as the Company looks to grow its business, and qualify him to serve on our board of directors.

Continuing Directors

Professor Michael Gorley, Ph.D., joined our board of directors in October 2023. Prof. Gorley has served as Chief Technologist at the UK Atomic Energy Authority (UKAEA) since September 2020. In this role, for the past three years Prof. Gorley has served as a strategic leader and program area manager for fusion technology at UKAEA. Prior to assuming his current role at UKAEA, Prof. Gorley was Materials Technology Group Leader from August 2018 to September 2020 and Materials Technology Programme Manager from June 2016 to August 2018. In these roles, Prof. Gorley directed the establishment of the Materials Technology Group and supporting Materials Testing Laboratories, and led the EUROfusion Engineering Data and Design Integration group. In addition, Prof. Gorley has been a visiting professor at the University of Bristol, U.K. since June 2021. Prof. Gorley received a Ph.D. (DPhil) in Materials Science from Oxford University, U.K., with a thesis on ODS steels (specialized alloys for high-performance applications).

We believe that Prof. Gorley’s significant expertise in fusion technology and fusion materials contributes to the Board’s understanding and ability to analyze and navigate complex regulatory and business issues.

| 7 |

| Table of Contents |

Duncan Moore, Ph.D. has served on our board of directors since October 2021. Duncan is a partner at East West Capital Partners since May 2008, which has a focus on making investments in the Healthcare Industry in Asia. Previously, from 1991 to 2008, Dr. Moore was a top-ranked pharmaceutical analyst at Morgan Stanley leading the firm’s global healthcare equity research team. Whilst at the University of Cambridge, he co-founded a medical diagnostics company called Ultra Clone with two colleagues which led to the beginnings of a 20-year career in healthcare capital markets analysis. In 1986, he was involved in setting up the BankInvest biotechnology funds and was on its scientific advisory board. Dr. Moore was educated in Edinburgh and went to the University of Leeds where he studied Biochemistry and Microbiology. He has a M.Phil. and Ph.D. from the University of Cambridge where he was also a post-doctoral research fellow. Currently, he is an active investor in biomedical companies as Chairman of Lamellar Biomedical and Allarity Therapeutics A/S (previously Oncology Venture A/S). In addition, he has a board position at Forward Pharma A/S, Cycle Pharma and GH Research. Duncan is the Chairman of the Scottish Life Sciences Association.

We believe that the experience, insights and knowledge Dr. Moore possesses from his leadership roles in business activities are important qualifications, skills and experience that provide valuable assistance to the Board and greatly contribute to the overall knowledge of the Board and its ability to address the issues we confront.

Hendrik Strydom, Ph.D. has served as our Chief Technology Officer since January 2022 and has served on our board of directors since January 2022. Dr. Strydom co-developed the isotope separation technology, known as “Aerodynamic Separation Process” (ASP). In 1993 Dr. Strydom co-founded SDI Ltd (subsequently named Klydon), a research and development company which developed the ASP. Klydon, where Dr. Strydom served as CEO, successfully exploited the ASP technology by separating Silicon (Si28), Carbon (C13 & C14), Oxygen (O-18) and Molybdenum (Mo-100). Since the commencement of commercial operation of the O-18 plant over 3 years ago, Klydon sold O-18 into the South African radio pharmacy market. Dr. Strydom’s work on separation of isotopes started when he was employed as a scientist at the South African Atomic Energy Corporation (AEC), where he specialized in the laser separation of heavy isotopes. Dr. Strydom left AEC in 1993 to co-found Klydon. Dr. Strydom holds a BSc- Hons (Physics & Maths) (1983) — University of Pretoria, MSc (Physics) (1990) — University of Port Elizabeth, PhD (Physics) (2000) — University of Natal (Durban).

As the founder and CEO of Klydon, Dr. Strydom brings to the Board his detailed knowledge and unique perspective and insights regarding the strategic and operational opportunities and challenges, economic and industry trends, and competitive and financial positioning of our business.

Todd Wider, M.D.has served on our board of directors since October 2021. Dr. Wider is the Executive Chairman and Chief Medical Officer of Emendo Biotherapeutics, which focuses on highly specific and differentiated next generation gene editing. Dr. Wider served on the board of directors of ARYA Sciences Acquisition Corp I, which had a successful business combination with Immatics N.V. (IMTX) in 2020. He served on the board of ARYA Sciences Acquisition Corp II, which had a successful business combination with Nautilus Biotechnology (NAUT) in 2021. He also served on the board of ARYA III, which had a successful business combination with Cerevel Therapeutics (CERE) in 2021. He is also on the boards of ARYA Sciences Acquisition Corp IV and V (ARYD and ARYE), Abeona Therapeutics Inc. (Nasdaq: ABEO), Varian Biopharma, Xanadu Bio, and Lyfebulb. Dr. Wider previously consulted with a number of entities in the biotechnology space. Dr. Wider is an active, honorary member of the medical staff of Mount Sinai Hospital in New York, where he worked for over 20 years, focused on reconstructive surgery. Dr. Wider received an MD from Columbia College of Physicians and Surgeons, where he was Rudin Fellow, and an AB, with high honors and Phi Beta Kappa, from Princeton University. He did his residency in general surgery and plastic and reconstructive surgery at Columbia Presbyterian Medical Center, and postdoctoral fellowships in complex reconstructive surgery at Memorial Sloan Kettering Cancer Center, where he was Chief Microsurgery Fellow, and in craniofacial surgery at the University of Miami. Dr. Wider is also a principal in Wider Film Projects, a documentary film company focused on producing films with sociopolitical resonance that have won Academy, Emmy and Peabody Awards.

| 8 |

| Table of Contents |

We believe Dr. Wider, as a result of his vast public and private company board experience at a variety of companies, possesses knowledge and experience in various areas, including business leadership, finance and technology, which strengthens the Board’s overall knowledge, capabilities and experience.

Board Independence

Our common stock is listed on the Nasdaq Capital Market. Under the rules of the Nasdaq Capital Market, independent directors must comprise a majority of a listed company’s board of directors within a specified period of the completion of our initial public offering. In addition, the rules of the Nasdaq Capital Market require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent.

Audit committee members and compensation committee members must also satisfy the independence criteria set forth in Rule 10A-3 and Rule 10C-1, respectively, under the Securities Exchange Act of 1934, as amended (“Exchange Act”). Under the rules of the Nasdaq Global Select Market, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

To be considered independent for purposes of Rule 10A-3 and under the rules of Nasdaq, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

To be considered independent for purposes of Rule 10C-1 and under the rules of Nasdaq, the board of directors must affirmatively determine that each member of the compensation committee is independent, including a consideration of all factors specifically relevant to determining whether the director has a relationship to the company which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (i) the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the company to such director and (ii) whether such director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company.

Our board of directors has determined that each of Joshua Donfeld, Michael Gorley, Ph.D., Duncan Moore, Ph.D. and Todd Wider, M.D. are independent directors. In making this determination, our board of directors applied the standards set forth under Rule 10A-3 of the Exchange Act and related SEC and Nasdaq rules. Our board of directors considered all relevant facts and circumstances known to it in evaluating the independence of these directors, including their current and historical employment, any compensation we have given to them, any transactions we have with them, their beneficial ownership of our capital stock, their ability to exert control over us, all other material relationships they have had with us and the same facts with respect to their immediate families.

Although there is no specific policy regarding diversity in identifying director nominees, both the nominating and corporate governance committee and the board of directors seek the talents and backgrounds that would be most helpful to us in selecting director nominees. In particular, the nominating and corporate governance committee, when recommending director candidates to our board of directors for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of board of directors’ members that represents a diversity of background and experience.

| 9 |

| Table of Contents |

Board Leadership Structure

Our board of directors is led by our Chair, Paul Mann. Our board of directors recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide effective oversight of management. Our Bylaws and corporate governance guidelines provide our board of directors with flexibility to combine or separate the positions of Chair of the Board and Chief Executive Officer. Our board of directors currently believes that our existing leadership structure is effective, under which Paul Mann serves as our chief executive officer, provides the appropriate balance of authority between independent and non-independent directors, and achieves the optimal governance model for us and for our stockholders.

The Board’s Role in Risk Oversight

Although management is responsible for the day-to-day management of the risks our company faces, our board of directors and its committees take an active role in overseeing management of our risks and have the ultimate responsibility for the oversight of risk management. The board of directors regularly reviews information regarding our operational, financial, legal and strategic risks. Specifically, senior management attends quarterly meetings of the board of directors, provides presentations on operations including significant risks, and is available to address any questions or concerns raised by our board of directors.

In addition, our three standing committees assist the board of directors in fulfilling its oversight responsibilities regarding risk. The audit committee coordinates the board of directors’ oversight of our internal control over financial reporting, disclosure controls and procedures, related party transactions and code of conduct and corporate governance guidelines and management regularly reports to the audit committee on these areas. The compensation committee assists the board of directors in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs as well as succession planning as it relates to our chief executive officer. The nominating and corporate governance committee assists the board of directors in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and corporate governance. When any of the three standing committees receives a report related to material risk oversight, the chair of the relevant committee reports on the discussion to the full board of directors.

Board of Directors Meetings

During fiscal year 2022, our board of directors met eight times, including telephonic meetings. In that year, each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he/she served as a director and (ii) the total number of meetings held by all committees of our board of directors on which he/she served during the periods that he/she served.

Committees of the Board of Directors

Our board of directors has three standing committees: the audit committee, the compensation committee, and the nominating and corporate governance committee, each of which operates pursuant to a charter adopted by our board of directors. Our board of directors may also establish other committees from time to time to assist the board of directors. As of the date of this proxy statement, the composition and functioning of all of our committees comply with all applicable requirements of the Sarbanes-Oxley Act, Nasdaq and SEC rules and regulations. Each committee’s charter is available on the Investor Relations portion of our website at https://investors.aspisotopes.com under Governance.

Audit Committee

The members of our audit committee are Todd Wider, Joshua Donfeld and Duncan Moore, with Dr. Wider serving as chair. The audit committee, which was formed in November 2022 in connection with the listing of our stock on Nasdaq, did not meet during 2022. Our board of directors has determined that each member of the audit committee has sufficient knowledge in financial and auditing matters to serve on the audit committee. Our board of directors has designated Mr. Donfeld as an “audit committee financial expert,” as defined under the applicable rules of the SEC. Our board of directors has determined that each member of the audit committee meets the independence requirements for audit committees required under Section 10A of the Exchange Act and the applicable Nasdaq rules. The audit committee’s responsibilities include:

| 10 |

| Table of Contents |

|

| · | appointing, approving the compensation of and assessing the independence of our independent registered public accounting firm; |

|

| · | pre-approving auditing and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm; |

|

| · | reviewing the overall audit plan with our independent registered public accounting firm and members of management responsible for preparing our financial statements; |

|

| · | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures as well as critical accounting policies and practices used by us; |

|

| · | coordinating the oversight and reviewing the adequacy of our internal control over financial reporting; |

|

| · | establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns; |

|

| · | recommending, based upon the audit committee’s review and discussions with management and our independent registered public accounting firm, whether our audited financial statements are included in our Annual Report on Form 10-K; |

|

| · | monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters; |

|

| · | preparing the audit committee report required by SEC rules to be included in our annual proxy statement; |

|

| · | reviewing all related person transactions for potential conflict of interest situations and approving all such transactions; and |

|

| · | reviewing quarterly earnings releases. |

Compensation Committee

The members of our compensation committee are Duncan Moore and Todd Wider with Mr. Moore serving as chair. The compensation committee, which was formed in November 2022 in connection with the listing of our stock on Nasdaq, did not meet during 2022. Our board of directors has determined that each member of the compensation committee is “independent” as that term is defined in SEC and Nasdaq rules, meets the heightened independence requirements for compensation committee purposes under Section 10C of the Exchange Act and related SEC and Nasdaq rules, and are considered a “non-employee director” under Rule 16b-3 under the Exchange Act. The compensation committee’s responsibilities include:

|

| · | reviewing and approving our philosophy, policies and plans with respect to the compensation of our chief executive officer; |

|

| · | making recommendations to our board of directors with respect to the compensation of our chief executive officer and our other executive officers; |

|

| · | reviewing and assessing the independence of compensation advisors; |

|

| · | overseeing and administering our equity incentive plans; |

|

| · | reviewing and making recommendations to our board of directors with respect to director compensation; and |

|

| · | preparing the compensation committee reports required by the SEC, including our “Executive Compensation” disclosure. |

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Joshua Donfeld, Duncan Moore and Michael Gorley (who replaced Sergey Vasnetsov in October 2023), with Mr. Donfeld serving as chair. The nominating and corporate governance committee, which was formed in November 2022 in connection with the listing of our stock on Nasdaq, did not meet during 2022. Our board of directors has determined that each member of the nominating and corporate governance committee is “independent” as defined in Nasdaq rules. The nominating and corporate governance committee’s responsibilities include:

|

| · | developing and recommending to the board of directors criteria for board and committee membership; |

|

| · | establishing procedures for identifying and evaluating board of director candidates, including nominees recommended by stockholders; |

| 11 |

| Table of Contents |

|

| · | reviewing the composition of the board of directors to ensure that it is composed of members containing the appropriate skills and expertise to advise us; |

|

| · | identifying and screening individuals qualified to become members of the board of directors; |

|

| · | recommending to the board of directors the persons to be nominated for election as directors and to each of the board’s committees; |

|

| · | developing and recommending to the board of directors a code of business conduct and ethics and a set of corporate governance guidelines; and |

|

| · | overseeing the evaluation of our board of directors and management. |

Special Projects Committee

In August 2023, the board of directors created the special projects committee whose responsibilities include to research, evaluate and negotiate strategic opportunities and alternatives available to the company, including potential joint ventures, collaborations and other key strategic transactions, and to make reports and recommendations to the board of directors. Mr. Moore was appointed to the special projects committee.

Director Nomination Process

The nominating and corporate governance committee use the following procedures to identify and evaluate any individual recommended or offered for nomination to the board of directors. In its evaluation of director candidates, including the members of the board of directors eligible for re-election, the nominating and corporate governance committee considers the following:

|

| · | individual qualifications, including relevant career experience, strength of character, maturity of judgment, familiarity with the Company’s business and industry; |

|

| · | the experience and expertise of the Company’s current directors; and |

|

| · | all other factors it considers appropriate, which may include diversity of background, existing commitments to other businesses, potential conflicts of interest, legal considerations, corporate governance background, financial and accounting background, executive compensation background and the size, composition and combined expertise of the existing board or directors. |

The board of directors, with the assistance of the nominating and corporate governance committee, monitors the mix of specific experiences, qualifications and skills of its directors in order to assure that the board of directors, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. Although there is no specific policy regarding diversity in identifying director nominees, both the nominating and corporate governance committee and the board of directors seek the talents and backgrounds that would be most helpful to us in selecting director nominees. In particular, the nominating and corporate governance committee, when recommending director candidates to the full board of directors for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of board of directors’ members that represents a diversity of background and experience. The Company has never received a director nomination proposal from a stockholder. Although the nominating and corporate governance committee has not adopted a formal policy with respect to stockholder nominees, the nominating and corporate governance committee expects that the evaluation process for a stockholder nominee would be similar to the process outlined above.

Stockholder Recommendations for Nominations to the Board

A stockholder that wishes to recommend a candidate for consideration by the nominating and corporate governance committee as a potential candidate for director must direct the recommendation in writing to ASP Isotopes Inc., 1101 Pennsylvania Avenue NW, Suite 300, Washington, DC 20004, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, class and number of shares of our capital stock that are held by the nominee, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between us and the candidate and evidence of the recommending stockholder’s ownership of our stock. Such recommendation must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for board membership, including issues of character, integrity, judgment, and diversity of experience, independence, area of expertise, corporate experience, potential conflicts of interest, other commitments and the like and personal references. Our board of directors will consider the recommendation but will not be obligated to take any further action with respect to the recommendation.

| 12 |

| Table of Contents |

Director Attendance at Annual Meetings

Although our Company does not have a formal policy regarding attendance by members of our board of directors at our Annual Meeting, we encourage all of our directors to attend. This Annual Meeting will be the first annual meeting of our stockholders.

Communications with our Board of Directors

Stockholders seeking to communicate with our board of directors should submit their written comments to our corporate secretary, ASP Isotopes Inc., 1101 Pennsylvania Avenue NW, Suite 300, Washington, DC 20004. The corporate secretary will forward such communications to each member of our board of directors; provided that, if in the opinion of our corporate secretary it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion).

Code of Business Conduct

We have adopted a written code of business conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is posted on the Investor Relations section of our website at www.aspisotopes.com. If we make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K within four business days of such amendment or waiver.

Director Compensation

The following table sets forth information regarding compensation earned by our non-employee-directors for service on our board of directors during the year ended December 31, 2022. Hendrik Strydom, Ph.D. joined our board of directors in January 2022.

| Name |

| Fees Earned or Paid in Cash ($) |

|

| Stock Awards ($) |

|

| Options ($) |

|

| Total ($) |

| ||||

| Josh Donfeld |

|

| — |

|

|

| 526,000 |

|

|

| 111,029 |

|

|

| 637,029 |

|

| Duncan Moore, Ph.D. |

|

| — |

|

|

| 526,000 |

|

|

| 111,029 |

|

|

| 637,029 |

|

| Sergey Vasnetsov(1) |

|

| — |

|

|

| 3,568,000 |

|

|

| — |

|

|

| 3,568,000 |

|

| Todd Wider, M.D. |

|

| — |

|

|

| 526,000 |

|

|

| 111,029 |

|

|

| 637,029 |

|

| (1) | Mr. Vasnetsov’s compensation for 2022 consists of stock awards for his services as a director and a consultant to the Company. |

We have entered into director agreements with Messrs. Donfeld, Gorley, Moore and Wider, pursuant to which we agreed to pay to each such director a fee for his service of $60,000 per year, payable at the director’s discretion in cash or Common Stock at market value. The fee is paid quarterly in arrears ($15,000 quarterly instalments) on the last business day of each December, March, June and September during the director’s term. In addition, we agreed to award a Common Stock award with a market value of $100,000 on October 13, 2022, and annually each year thereafter during the director’s term. Directors who are also our employees will not receive fees for service on our board of directors.

| 13 |

| Table of Contents |

ELECTION OF CLASS I DIRECTORS

Under our governing documents our board of directors has the power to set the number of directors from time to time by resolution. We currently have six authorized directors serving on our board of directors, four of whom are “independent” as defined under the Nasdaq listing standards. In accordance with our certificate of incorporation, our board of directors is divided into three classes with staggered three-year terms. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of our company.

At the Annual Meeting, two Class I directors will be elected for three-year terms. Based upon the recommendation of our nominating and corporate governance committee, our board of directors has nominated each of the director nominees set forth below to stand for election by our stockholders, in each case for a three-year term expiring at our 2026 annual meeting of stockholders or until his successor is duly elected and qualified.

Nominees for Director

Our nominating and corporate governance committee has recommended, and our board of directors has approved, Paul Mann and Joshua Donfeld as nominees for election as Class I directors at the Annual Meeting.

If elected, Paul Mann and Joshua Donfeld will serve as Class I directors until the 2026 annual meeting of stockholders or until their successors are duly elected and qualified. For information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance — Nominees for Director.”

If you are a stockholder of record and you vote but do not give instructions with respect to the voting of directors, your shares will be voted FOR the election of Paul Mann and Joshua Donfeld. We expect that Paul Mann and Joshua Donfeld will accept such nomination; however, in the event that a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by our board of directors to fill such vacancy. If you are a beneficial owner of shares of our common stock and you do not give voting instructions to your broker, bank or other nominee, then your broker, bank or other nominee will leave your shares unvoted on this matter.

Vote Required

The election of the Class I directors requires a plurality vote of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Abstentions, “withhold” votes and broker non-votes will have no effect on this proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE DIRECTORS NOMINATED BY OUR BOARD OF DIRECTORS AND NAMED IN THIS PROXY STATEMENT AS CLASS I DIRECTORS TO SERVE FOR THREE-YEAR TERMS.

| 14 |

| Table of Contents |

RATIFICATION OF SELECTION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee has selected EisnerAmper LLP (“EisnerAmper”) as the Company’s independent registered public accounting firm for the year ending December 31, 2023, and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. EisnerAmper has served as the Company’s auditor since 2021 and has audited the Company’s financial statements for the year ended December 31, 2022. Representatives of EisnerAmper are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

Stockholder ratification of the selection of EisnerAmper as the Company’s independent registered public accounting firm is not required by Delaware law, the Company’s amended and restated certificate of incorporation, or the Company’s amended and restated bylaws. However, the audit committee is submitting the selection of EisnerAmper to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether to retain that firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the audit committee determines that such a change would be in the best interests of the Company and its stockholders.

Independent Registered Public Accountants’ Fees

The following table is a summary of fees billed to the Company by EisnerAmper for professional services rendered for the fiscal years ended December 31, 2022 and 2021.

|

|

| 2022 |

|

| 2021 |

| ||

| Audit Fees(1) |

| $ | 243,607 |

|

| $ | 68,250 |

|

| Audit Related Fees |

|

| — |

|

|

| — |

|

| Tax Fees(2) |

|

| — |

|

|

| — |

|

| All Other Fees |

|

| — |

|

|

| — |

|

| Total |

| $ | 243,607 |

|

| $ | 68,250 |

|

(1) Audit fees in 2022 include audit, reviews, and work related to the filing of Form S-1, including issuances of consents and comfort letter.

(2) Tax fees are related to tax compliance and advisory services.

Pre-Approval Policies and Procedures

Our audit committee has established a policy that all audit and permissible non-audit services provided by our independent registered public accounting firm will be pre-approved by the audit committee, and all such services were pre-approved in accordance with this policy during the fiscal years ended December 31, 2022 and 2021. These services may include audit services, audit-related services, tax services and other services. The audit committee considers whether the provision of each non-audit service is compatible with maintaining the independence of our auditors. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

| 15 |

| Table of Contents |

Vote Required; Recommendation of the Board of Directors

The affirmative vote from a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote will be required to ratify the selection of EisnerAmper. Abstentions will have the same effect as a vote “against” this proposal. As ratification of the appointment of EisnerAmper LLP is considered a routine matter on which a broker or other nominee has discretionary authority to vote, no broker non-votes will likely result from this proposal.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE TO RATIFY THE SELECTION OF EISNERAMPER AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023. PROXIES SOLICITED BY THE BOARD OF DIRECTORS WILL BE SO VOTED UNLESS STOCKHOLDERS SPECIFY OTHERWISE.

***

Report of the Audit Committee of the Board of Directors

The audit committee oversees the Company’s financial reporting process on behalf of the Company’s board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed and discussed with management the audited financial statements for the fiscal year ended December 31, 2022, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed with EisnerAmper, which is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards and the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. In addition, the audit committee has discussed with EisnerAmper its independence from management and the company, has received from EisnerAmper the written disclosures and the letter required by applicable requirements of the PCAOB regarding EisnerAmper’s communications with the audit committee concerning independence, and has considered the compatibility of non-audit services with the auditors’ independence.

The audit committee met with EisnerAmper to discuss the overall scope of its services, the results of its audit and reviews, its evaluation of the Company’s internal controls and the overall quality of the Company’s financial reporting. EisnerAmper, as the Company’s independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the Company’s reporting. The audit committee’s meetings with EisnerAmper were held with and without management present. The audit committee is not employed by the Company, nor does it provide any expert assurance or professional certification regarding the Company’s financial statements.

The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee recommended to the Company’s board of directors that the audited financial statements of the Company be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 that was filed with the SEC. The audit committee and the Company’s board of directors also have recommended, subject to stockholder approval, the ratification of the appointment of EisnerAmper as the Company’s independent registered public accounting firm for 2023.

This report of the audit committee is not “soliciting material,” shall not be deemed “filed” with the SEC and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

|

| Submitted by the Audit Committee of the Board of Directors |

|

| Todd Wider, M.D. (Chair) |

|

| Joshua Donfeld |

|

| Duncan Moore, Ph.D. |

| 16 |

| Table of Contents |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information relating to the beneficial ownership of our common stock as of October 27, 2023, by:

|

| · | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding shares of common stock; |

|

| · | each of our directors; |

|

| · | each of our named executive officers; and |

|

| · | all directors and executive officers as a group. |

The number of shares beneficially owned by each entity, person, director or executive officer is determined in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares over which the individual has sole or shared voting power or investment power as well as any shares that the individual has the right to acquire within 60 days of October 27, 2023, through the exercise of any stock option, warrants or other rights or vesting of restricted stock units. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock held by that person.

The percentage of shares beneficially owned is computed on the basis of 48,873,276 shares of our common stock outstanding as of October 27, 2023. Shares of our common stock that a person has the right to acquire within 60 days of October 27, 2023, are deemed outstanding for purposes of computing the percentage ownership of the person holding such rights, but are not deemed outstanding for purposes of computing the percentage ownership of any other person, except with respect to the percentage ownership of all directors and executive officers as a group. Unless otherwise indicated below, the address for each beneficial owner listed is c/o ASP Isotopes Inc., 1101 Pennsylvania Avenue NW, Suite 300, Washington, DC 20004.

| Name and Address of Beneficial Owner |

| Number of Shares Beneficially Owned |

|

| Percentage of Shares Beneficially Owned(1) |

| ||

| 5% and Greater Stockholders |

|

|

|

| ||||

| AK Jensen Investment Management Ltd (2) |

|

| 6,516,874 |

|

|

| 13.3 | % |

| Einar Ronander, Ph.D. (3) |

|

| 2,097,424 |

|

|

| 4.3 | % |

| Sergey Vasnetsov (4) |

|

| 3,838,607 |

|

|

| 7.9 | % |

| Named Executive Officers and Directors |

|

|

|

| ||||

| Paul Mann (5) |

|

| 6,493,865 |

|

|

| 13.3 | % |

| Robert Ainscow (6) |

|

| 1,079,917 |

|

|

| 2.2 | % |

| Hendrick Strydom, Ph.D. (7) |

|

| 2,422,563 |

|

|

| 5.0 | % |

| Josh Donfeld (8) |

|

| 1,200,167 |

|

|

| 2.5 | % |

| Michael Gorley, Ph.D. (9) |

|

| 100,000 |

|

| * |

| |

| Duncan Moore, Ph.D. (10) |

|

| 950,167 |

|

|

| 1.9 | % |

| Todd Wider, M.D. (11) |

|

| 590,844 |

|

|

| 1.2 | % |

| All current executive officers and directors as a group (7 persons) (12) |

|

| 12,837,523 |

|

|

| 26.3 | % |

| 17 |

| Table of Contents |

* Less than one percent.

| (1) | Percentage ownership is calculated based on 48,873,276 shares of our common stock outstanding on October 27, 2023. |

| (2) | The securities are directly held by Tees River Critical Resources Fund or other funds and accounts ("AK Jensen Funds") to which AK Jensen Investment Management Limited ("AK Jensen") serves as the investment manager. Anders K. Jensen ("Mr. Jensen") and Duncan P. Saville ("Mr. Saville") may be deemed to indirectly control AK Jensen. AK Jensen and Messrs. Jensen and Saville disclaim beneficial ownership of the securities except to the extent of their pecuniary interest therein, if any. The address of AK Jensen is 1 Cornhill, London, EC3V 3ND. |

| (3) | Such shares are held by Carlein Investments (Pty) Ltd whose address is Building 46, CSIR Campus, Meiring Naude Road, Brummeria, Pretoria, 0184. Dr. Ronander has voting and dispositive power over such shares. |

| (4) | Consists of (i) 1,000,000 shares held by Elista LLC, (ii) 600,000 restricted shares of Common Stock granted by us to ChemBridges LLC in October 2021, which vest quarterly over one year and are subject to forfeiture, (iii) 600,000 restricted shares of Common Stock granted by us to ChemBridges LLC in July 2022, which vest quarterly over one year, (iv) 600,000 restricted shares of Common Stock awarded by us to ChemBridges LLC on November 15, 2022, which vest over four years, (v) 500,000 restricted shares of Common Stock awarded by us to ChemBridges LLC on December 30, 2022, which vest over one year, and (vi) 538,607 restricted shares of Common Stock awarded by us to ChemBridges LLC on March 1, 2023, which vest over one year. Mr. Vasnetsov has voting and dispositive power over the securities held by Elista LLC, whose address is P.O. Box 2291, Toa Baja 00951 Puerto Rico, as trustee of Eliona Trust (a family trust and owner of Elista LLC). Mr. Vasnetsov has voting and dispositive power over the securities held by ChemBridges LLC, whose address is P.O. Box 2291, Toa Baja 00951 Puerto Rico, as the President and owner of ChemBridges LLC. |

| (5) | Consists of (i) 1,550,000 shares of Common Stock held by Mr. Mann, (ii) 1,500,000 shares of performance-based restricted Common Stock granted by us to Mr. Mann in October 2021, (iii) 37,500 shares of common stock purchased in our Initial Public Offering, (iv) 1,000,000 restricted shares awarded by us to Mr. Mann on November 15, 2022, which vest over four years (v) 1,000,000 restricted shares of common stock awarded by us to Mr. Mann on December 30, 2022, which vest over one year (vi) 718,143 restricted shares of common stock awarded by us to Mr. Mann on March 1, 2023, which vest over one year, and (vii) 688,222 shares of Common Stock issuable upon exercise of options held by Mr. Mann exercisable within 60 days of October 27, 2023. |

| (6) | Consists of (i) 250,000 shares of Common Stock held by Mr. Ainscow (ii) 600,000 shares of Common Stock awarded by us to Mr. Ainscow on November 15, 2022, which vest over four years (iii) 50,000 restricted shares of Common Stock awarded by us to Mr. Ainscow on December 30, 2022, which vest over one year, and (iv) 179,917 shares of Common Stock issuable upon exercise of options held by Mr. Ainscow exercisable within 60 days of October 27, 2023. |

| (7) | Consists of (i) 2,097,474 shares held by Tianne Holdings (Pty) Ltd whose address is Building 46, CSIR Campus, Meiring Naude Road, Brummeria, Pretoria, 0184. Dr. Strydom has voting and dispositive power over such shares, (ii) 200,000 restricted shares of Common Stock awarded by us to Mr. Strydom on November 15, 2022, which vest over two years, and (iii) 125,139 shares of Common Stock issuable upon exercise of options held by Dr. Strydom within 60 days of October 27, 2023. |

| (8) | Consists of (i) 904,167 shares of Common Stock held by Mr. Donfeld, (ii) 200,000 restricted shares of Common Stock awarded by us to Mr. Donfeld on November 15, 2022, which vest over two years, and (iii) 96,000 shares of Common Stock issuable upon exercise of options held by Mr. Donfeld exercisable within 60 days of October 27, 2023. |

| (9) | Consists of 100,000 shares of Common Stock awarded by us to Mr. Gorley on October 23, 2023. |

| (10) | Consists of (i) 454,167 shares of Common Stock held by Mr. Moore, (ii) 200,000 restricted shares of Common Stock awarded by us to Mr. Moore on November 15, 2022, which vest over two years, (iii) 200,000 Shares of Common Stock awarded by us to Mr. Moore on August 16, 2023, and (iv) 96,000 shares of Common Stock issuable upon exercise of options held by Dr. Moore exercisable within 60 days of October 27, 2023. |