As filed with the Securities and Exchange Commission on May 9, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| ASP Isotopes Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

| 87-2618235 |

| (State or other jurisdiction of |

| (I.R.S. Employer |

| incorporation or organization) |

| Identification Number) |

1101 Pennsylvania Avenue NW, Suite 300

Washington, D.C. 20004

(202) 756-2245

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

Paul E. Mann

Executive Chairman and Chief Executive Officer

ASP Isotopes Inc.

1101 Pennsylvania Avenue NW, Suite 300

Washington, D.C. 20004

(202) 756-2245

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

| Donald G. Ainscow |

| Blank Rome LLP |

| 200 Crescent Court, Suite 1000 |

| Dallas, TX 75201 |

| (972) 850-1450 |

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholder named in this prospectus may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 9, 2024

PROSPECTUS

1,225,000 Shares of Common Stock

This prospectus covers the resale, from time to time, by the selling stockholder identified in this prospectus, or, the selling stockholder, of up to 1,225,000 shares of common stock, par value $0.01 per share, of ASP Isotopes Inc. (“common stock”), issuable upon the exercise of warrants held by the selling stockholder (“Warrants”). The shares of common stock issuable upon exercise of the Warrants are sometimes referred to herein as the “Warrant Shares.”

Our registration of the resale of the Warrant Shares does not mean that the selling stockholder will offer or sell any such shares. The selling stockholder received the Warrants from us pursuant to a private placement transaction that closed on April 10, 2024 pursuant to the terms of a Warrant Inducement Letter Agreement, dated as of April 9, 2024 (the “Inducement Agreement”), between us and the selling stockholder.

We will not receive any of the proceeds from the sale of the Warrant Shares by the selling stockholder, although we will receive proceeds from the exercise price of the Warrants.

Any shares of our common stock subject to resale hereunder will have been issued by us and received by the selling stockholder prior to any resale of such shares pursuant to this prospectus.

The selling stockholder may sell all or a portion of the shares of common stock beneficially owned by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling stockholder will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. We will bear all fees and expenses incident to our obligation to register the shares of common stock. For additional information on the methods of sale that may be used by the selling stockholder, see “Plan of Distribution” beginning on page 12 of this prospectus.

Our common stock is listed on The Nasdaq Capital Market, or Nasdaq, under the symbol “ASPI.” On May 8, 2024, the last reported sale price of our common stock was $3.62 per share.

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and are subject to reduced disclosure and public reporting requirements. See “Summary — Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 6 of this prospectus any similar section contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus as described on page 15 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2024.

| ii |

| ||

|

| 1 |

| |

|

| 6 |

| |

|

| 7 |

| |

|

| 9 |

| |

|

| 10 |

| |

|

| 12 |

| |

|

| 14 |

| |

|

| 14 |

| |

|

| 14 |

| |

|

| 15 |

|

| i |

| Table of Contents |

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. The selling stockholder may resell, from time to time, in one or more offerings, shares of our common stock offered by this prospectus. Information about the selling stockholder may change over time. When the selling stockholder sells shares of our common stock under this prospectus, we will, if necessary and required by law, provide a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information contained in this prospectus. If a prospectus supplement is provided and the description of the offering in the prospectus supplement varies from the information in this prospectus, you should rely on the information in the prospectus supplement. You should carefully read this prospectus and any accompanying prospectus supplement, if any, along with all of the information incorporated by reference herein and therein, before making an investment decision.

You should rely only on the information contained or incorporated by reference in this prospectus and any applicable prospectus supplement. We have not, and the selling stockholder has not, authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. This prospectus is not an offer to sell, nor is the selling stockholder seeking an offer to buy, the shares offered by this prospectus in any jurisdiction where the offer and sale is not permitted. No offers or sales of any of the shares of our common stock are to be made in any jurisdiction in which such an offer or sale is not permitted. You should assume that the information contained in this prospectus or any applicable prospectus supplement is accurate only as of the date on the front cover thereof or the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sales of the shares of our common stock offered hereby or thereby.

You should read the entire prospectus and any prospectus supplement and any related issuer free writing prospectus, as well as the documents incorporated by reference into this prospectus or any prospectus supplement or any related issuer free writing prospectus, before making an investment decision. Neither the delivery of this prospectus or any prospectus supplement or any issuer free writing prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated by reference herein or in any prospectus supplement or issuer free writing prospectus, as applicable. You should assume that the information appearing in this prospectus, any prospectus supplement or any document incorporated by reference herein or therein is accurate only as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our business, financial condition, results of operation and prospects may have changed since that date.

This prospectus and the information incorporated herein by reference contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

Unless otherwise stated, all references in this prospectus to “we,” “us,” “our,” “ASP Isotopes,” the “Company” and similar designations refer to ASP Isotopes Inc. This prospectus contains references to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| ii |

| Table of Contents |

The following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Unless the context indicates otherwise, references in this prospectus to “ASPI,” “ASP Isotopes,” “the Company,” “we,” “us,” “our” and similar references refer to ASP Isotopes Inc.

Overview

We are a development stage advanced materials company dedicated to the development of technology and processes that, if successful, will allow for the enrichment of natural isotopes into higher concentration products, which could be used in several industries. Our proprietary technology, the Aerodynamic Separation Process (“ASP technology”), originally developed by Klydon Proprietary Ltd (“Klydon”), is designed to enable the production of enriched isotopes used in several industries. Our initial focus is on the production and commercialization of enriched Carbon-14 (“C-14”), Molybdenum-100 (“Mo-100”) and Silicon-28 (“Si-28”). We have commissioned an isotope enrichment plant for the enrichment of C-14 located in Pretoria, South Africa, which will be ready for production upon the final installation of essential components. We anticipate completion and commissioning of a multi-isotope enrichment plant in Pretoria, South Africa in mid-2024. In addition, we have started planning additional isotope enrichment plants. We believe the C-14 we may produce using the ASP technology could be used in the development of new pharmaceuticals and agrochemicals. We believe the Mo-100 we may produce using the ASP technology could have significant potential advantages for use in the preparation of nuclear imaging agents by radiopharmacies and others in the medical industry. We believe the Si-28 we may produce using the ASP technology may be used to create advanced semiconductors and in quantum computing. In addition, we are considering the future development of the ASP technology for the separation of Zinc-68, Xenon-129/136 for potential use in the healthcare end market, Germanium 70/72/74 for possible use in the semiconductor end market, and Chlorine -37 for potential use in the nuclear energy end market.

We are also developing Quantum Enrichment technology to produce enriched Ytterbium-176, Nickel-64, Lithium 6, Lithium7 and Uranium-235 (“U-235”). Quantum enrichment is an advanced isotope enrichment technique that is currently in development that uses lasers. We believe that the U-235 we may produce using quantum enrichment technology may be commercialized as a nuclear fuel component for use in the new generation of high-assay low-enriched uranium (HALEU)-fueled small modular reactors that are now under development for commercial and government uses.

The aerodynamic separation technique has its origins in the South African uranium enrichment program in the 1980s, and the ASP technology has been developed during the last 18 years by the scientists at Klydon. In Klydon’s testing, the ASP technology has demonstrated efficacy and commercial scalability in enriching oxygen-18 and silicon-28. ASP Isotopes Inc. was incorporated in Delaware in September 2021 to acquire assets and license intellectual property rights related to the production of Mo-100 using the ASP technology. In January 2022, we also licensed intellectual property rights associated with the production of U-235 using the ASP technology. In July 2022, we licensed intellectual property rights related to the production of all isotopes using the ASP technology. In April 2023, we acquired certain intellectual property assets of Klydon.

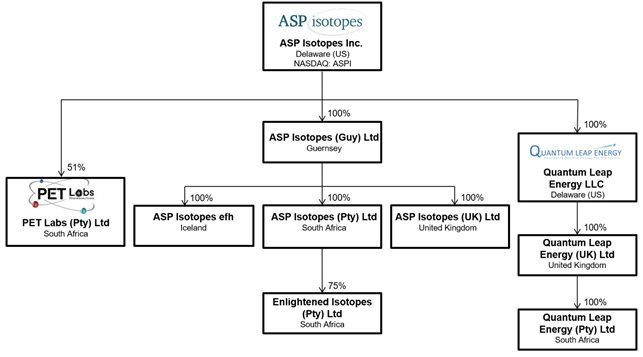

We operate principally through subsidiaries: ASP Isotopes Guernsey Limited (the holding company of ASP Isotopes South Africa (Proprietary) Limited and Enlightened Isotopes (Pty) Ltd), which will be focused on the development and commercialization of high-value, low-volume isotopes for highly specialized end markets (such as C-14, Mo-100, and Si-28). In September 2023, we formed a new subsidiary, Quantum Leap Energy LLC, which also has a subsidiary in the United Kingdom (Quantum Leap Energy Ltd), to focus on the development and commercialization of advanced nuclear fuels such as HALEU and Lithium-6. ASP Isotopes UK Ltd is the owner of our technology. In addition, in the fourth quarter of 2023, we entered into a strategic relationship with Pet Labs Pharmaceuticals Proprietary Limited (PET Labs) by acquiring a 51% ownership stake in PET Labs. We anticipate this transaction will allow us to enter the downstream medical isotope production and distribution market.

| 1 |

| Table of Contents |

Our corporate structure and ownership of our subsidiaries is set forth in the chart below:

Our Strategy

Our goal is to develop technology and processes that, if successful, will allow for the production of isotopes that may be used in medical isotopes, nuclear power, or other industries. Key elements of our strategy to achieve this goal include:

|

| · | Completing development and commissioning of our enrichment facilities in Pretoria, South Africa. |

|

| · | Demonstrating the capability to produce C-14, Mo-100, and Si-28 using the ASP technology and capitalize on the opportunity to solve many supply chain challenges that currently exist. |

|

| · | Continuing to identify potential offtake customers and strategic partners for our isotopes. |

|

| · | Demonstrating the capability to produce high-assay low-enriched uranium (HALEU) using Quantum Enrichment and meet anticipated demand for the new generation of HALEU-fueled small modular reactors and advanced reactor designs that are now under development for commercial and government uses. |

|

| · | Initiating the R&D efforts of the Quantum Enrichment Process via the Company’s subsidiary, Enlightened Isotopes, for the enrichment of Ytterbium 176. |

|

| · | Introducing Mo-100 produced using ASP technology as an alternative and potentially more convenient production route for Tc-99m. |

|

| · | Demonstrating the effectiveness and value in the use of Mo-100 and other stable isotopes in the downstream radiopharmacy market, after acquiring 51% ownership interest in PET Labs, the leading radiopharmacy in South Africa. This investment will address the radioisotope needs of South Africa as well as certain neighboring countries. |

| 2 |

| Table of Contents |

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

|

| · | reduced obligations with respect to financial data, including presenting only two years of audited financial statements and only two years of selected financial data; |

|

| · | an exemption from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

|

| · | reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements, and registration statements; and |

|

| · | exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements. |

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and, therefore, we will not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies or that have opted out of using such extended transition period, which may make comparison of our financial statements with those of other public companies more difficult. We may take advantage of these reporting exemptions until we no longer qualify as an emerging growth company, or, with respect to adoption of certain new or revised accounting standards, until we irrevocably elect to opt out of using the extended transition period.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.235 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. We may choose to take advantage of some but not all of these reduced reporting burdens.

We are also a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies until the fiscal year following the determination that our voting and non-voting common stock held by non-affiliates is $250 million or more measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is $700 million or more measured on the last business day of our second fiscal quarter.

Corporate Information

We were incorporated in Delaware in September 2021. Our principal executive offices are located at 1101 Pennsylvania Avenue NW, Suite 300, Washington, DC 20004, and our telephone number is (202) 756-2245. Our website address is www.aspisotopes.com. Information contained on, or that can be accessed through, our website is not part of and is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

| 3 |

| Table of Contents |

Private Placement

On April 9, 2024, we entered into a warrant inducement letter agreement (the “Inducement Agreement”) with the selling stockholder pursuant to which the selling stockholder agreed to exercise for cash previously issued warrants to purchase up to 3,164,557 shares of common stock (the “Existing Warrants”), at an exercise price of $1.75 per share. The transactions contemplated by the Inducement Agreement closed on April 10, 2024. We received aggregate gross proceeds of approximately $5.5 million, before deducting expenses payable by the Company.

In consideration of the selling stockholder’s immediate exercise of the Existing Warrants in accordance with the Inducement Agreement, we issued unregistered, newly issued warrants (the “Warrants”) to purchase 1,225,000 shares of common stock to the selling stockholder.

In addition, pursuant to the Inducement Agreement, we agreed not to issue any shares of Common Stock or Common Stock equivalents (as defined in the Inducement Agreement) or to file any other registration statement with the SEC (in each case, subject to certain exceptions) until 30 days after the closing. We also agreed not to effect or agree to effect any Variable Rate Transaction (as defined in the Inducement Agreement) until 180 days after closing.

Under the terms of the Inducement Agreement, we agreed to file a registration statement to register the resale of the Warrant Shares (the “Resale Registration Statement”) on or before 30 days from the date of the Inducement Agreement, and to use best efforts to have such Resale Registration Statement declared effective by the SEC within 45 days (or, in the event of a full review, 90 calendar days) following the date of the Inducement Agreement.

Terms of the Warrants

The Warrants have an exercise price of $3.90 per share and will be exercisable on and after October 10, 2024 (the date that is six months following the date of issuance). The Warrants will expire on October 10, 2029 (the five year anniversary of their initial exercise date). If at the time of exercise, there is no effective registration statement registering, or the prospectus contained therein is not available for the resale of the Warrant Shares by the Holder, then the Warrants may also be exercised, in whole or in part, at such time by means of a “cashless exercise.”

The exercise price and the number of shares of Common Stock issuable upon exercise of each Warrant are subject to appropriate adjustments in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting the common stock. In the event of a fundamental transaction, as described in the Warrants, the holders of the Warrants will be entitled to receive upon exercise of the Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the Warrants immediately prior to such fundamental transaction. In addition, in certain circumstances, upon a fundamental transaction, the holder will have the right to require us to repurchase its Warrants at the Black Scholes Value; provided, however, that, if the fundamental transaction is not within the our control, including not approved by our board of directors, then the holder shall only be entitled to receive the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Warrant, that is being offered and paid to the holders of common stock in connection with the fundamental transaction.

We may not affect the exercise of Warrants, and the Holder will not be entitled to exercise any portion of any such Warrants, which, upon giving effect to such exercise, would cause the aggregate number of shares of Common Stock beneficially owned by the Holder of such Warrants (together with its affiliates) to exceed 4.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of such Warrants.

Except as otherwise provided in the Warrants or by virtue of such holder’s ownership of shares of Common Stock, a holder of Warrants will not have the rights or privileges of a holder of Common Stock, including any voting rights, until such holder exercises such holder’s Warrants. The Warrants will provide that the holders of the Warrants have the right to participate in distributions or dividends paid on shares of common stock.

The Warrants described herein have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be sold in the United States absent registration or an applicable exemption from the registration requirements.

The foregoing descriptions of each of the Inducement Agreement and the Warrants do not purport to be complete and are each qualified in their entirety by reference to the full text of the forms of the Inducement Agreement and the Warrant copies of which are filed as exhibits to the registration statement of which this prospectus forms a part, and are incorporated by reference herein.

| 4 |

| Table of Contents |

The Offering

| Common stock offered by us |

| None. |

|

|

|

|

| Common stock offered by the selling stockholder |

| Up to 1,225,000 shares of our common stock, par value $0.01 per share, issuable upon the exercise of the Warrants held by the selling stockholder. |

|

|

|

|

| Common stock currently outstanding |

| 51,762,833 (as of April 30, 2024) |

|

|

|

|

| The Warrants |

| The Warrants have an exercise price of $3.90 per share and will be exercisable on and after October 10, 2024 (the date that is six months following the date of issuance). The Warrants will expire on October 10, 2029 (the five year anniversary of their initial exercise date). If at the time of exercise, there is no effective registration statement registering, or the prospectus contained therein is not available for the resale of the Warrant Shares by the Holder, then the Warrants may also be exercised, in whole or in part, at such time by means of a “cashless exercise.”

The selling stockholder may not resell the Warrants pursuant to the registration statement of which this prospectus forms a part and may only sell the shares issuable upon the exercise of the Warrants held by it pursuant to the registration statement of which this prospectus forms a part. |

|

|

|

|

| Selling stockholders |

| All of the shares of our common stock are being offered by the selling stockholder. See “Selling Stockholder” beginning on page 10 for additional information on the selling stockholder. |

|

|

|

|

| Terms of the offering |

| The selling stockholder will determine when and how it will sell the common stock offered in this prospectus, as described in “Plan of Distribution.” |

|

|

|

|

| Use of proceeds |

| We will not receive any proceeds from the sale of the shares of common stock covered by this prospectus. |

|

|

|

|

| Risk factors |

| See “Risk Factors” beginning on page 6, for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

|

|

|

| Nasdaq Capital Market symbol |

| ASPI |

The selling stockholder named in this prospectus may offer and sell up to 1,225,000 shares of our common stock. Our common stock is currently listed on The Nasdaq Capital Market under the symbol “ASPI”. Shares of our common stock that may be offered under this prospectus will be fully paid and non-assessable. We will not receive any of the proceeds of sales by the selling stockholder of any of the common stock covered by this prospectus. Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholder for offer and resale, we are referring to the shares of common stock issued to the selling stockholder, or issuable upon exercise of the Warrants, in the Private Placement as described above. When we refer to the selling stockholder in this prospectus, we are referring to the selling stockholder identified in this prospectus and, as applicable, its permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

| 5 |

| Table of Contents |

Investing in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in our Annual Report on Form 10-K for the year ended December 31, 2023, as well as any amendments thereto, as updated by our annual, quarterly and other reports and documents that are incorporated by reference into this prospectus, before deciding whether to purchase any of the securities being registered pursuant to the registration statement of which this prospectus is a part. Each of the risk factors could adversely affect our business, results of operations, financial condition and cash flows, as well as adversely affect the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations.

The sale of a substantial number of shares of our common stock in the public market, including resale of the Warrant Shares issuable to the selling stockholder upon exercise of the Warrants, could adversely affect the prevailing market price for our common stock.

We are registering for resale up to 1,225,000 shares of our common stock issuable upon exercise of Warrants to fulfill our contractual obligations under the Inducement Agreement. Sales of substantial amounts of shares of our common stock in the public market, or the perception that such sales might occur, could adversely affect the market price of our common stock. We cannot predict if and when the selling stockholder may sell such shares in the public markets. Furthermore, in the future, we may issue additional shares of our common stock or other equity or debt securities exercisable for, or convertible into, shares of our common stock. Any such issuances could result in substantial dilution to our existing stockholders and could cause our stock price to decline.

| 6 |

| Table of Contents |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the information incorporated herein by reference, contains, and any prospectus supplement may contain, forward-looking statements. These statements are based on our management’s current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us. Discussions containing these forward-looking statements may be found, among other places, in the sections titled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2023, as well as any amendments thereto, as updated by our annual, quarterly and other reports and documents that are incorporated by reference into this prospectus.

In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “positioned,” “potential,” “seek,” “should,” “target,” “will,” “would” or the negative or plural of those terms, and similar expressions intended to identify statements about the future, although not all forward-looking statements contain these words. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these statements.

Any statements in this prospectus, or incorporated herein by reference, about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

|

| · | our ability to complete the construction of, commission and successfully operate isotope enrichment plants in a cost-effective manner; |

|

| · | our ability to meet, and to continue to meet, applicable regulatory requirements for the use of the isotopes we may produce using the ASP technology or the Quantum Enrichment process; |

|

| · | our ability to obtain regulatory approvals for the production and distribution of isotopes; |

|

| · | our ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the ASP technology, the Quantum Enrichment process and our enrichment facilities in South Africa; |

|

| · | the introduction, market acceptance and success of Mo-100 that we may produce using ASP technology as an alternative and potentially more convenient production route for Tc-99m; |

|

| · | the success or profitability of our future offtake arrangements with respect to various isotopes that we may produce using ASP technology or the Quantum Enrichment process; |

|

| · | a failure of demand for various isotopes that we may produce using ASP technology or the Quantum Enrichment process; |

|

| · | our future capital requirements and sources and uses of cash; |

|

| · | our ability to obtain funding for our operations and future growth; |

|

| · | the extensive costs, time and uncertainty associated with new technology development; |

|

| · | developments and projections relating to our competitors and industry; |

|

| · | the ability to recognize the anticipated benefits of acquisitions, including our acquisition of assets of Molybdos (Pty) Limited in the “business rescue” auction, the assets and intellectual property we acquired from Klydon Proprietary Ltd, and our investment in PET Labs Pharmaceuticals; |

|

| · | problems with the performance of the ASP technology or the Quantum Enrichment process in the enrichment of isotopes; |

|

| · | our dependence on a limited number of third-party suppliers for certain components; |

| 7 |

| Table of Contents |

|

| · | our inability to adapt to changing technology and diagnostic landscape, such as the emergence of new diagnostic scanners or tracers; |

|

| · | our expected dependence on a limited number of key customers for isotopes that we may produce using ASP technology or the Quantum Enrichment process; |

|

| · | our inability to protect our intellectual property and the risk of claims that we have infringed on the intellectual property of others; |

|

| · | our inability to compete effectively; |

|

| · | risks associated with the current economic environment; |

|

| · | risks associated with our international operations; |

|

| · | we are subject to credit counterparty risks; |

|

| · | geopolitical risk and changes in applicable laws or regulations; |

|

| · | our inability to adequately protect our technology infrastructure; |

|

| · | our inability to hire or retain skilled employees and the loss of any of our key personnel; |

|

| · | operational risk; |

|

| · | costs and other risks associated with being a reporting company and becoming subject to the Sarbanes-Oxley Act; |

|

| · | our inability to implement and maintain effective internal controls; and |

|

| · | other factors that are described in “Risk Factors,” beginning on page 6. |

You should refer to the “Risk Factors” section contained in any applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements in this prospectus will prove to be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

| 8 |

| Table of Contents |

The selling stockholder will receive all of the proceeds of the sale of shares of common stock offered from time to time pursuant to this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of common stock that may be sold from time to time pursuant to this prospectus; however, we will receive proceeds from the cash exercise of the Warrants. If exercised in full, we would receive gross proceeds of $4,777,500 from the exercise of the Warrants. There can be no assurance that the Warrants will be exercised. We intend to use the net proceeds from the exercise of the Warrants for general corporate and working capital purposes.

We will bear the out-of-pocket costs, expenses and fees incurred in connection with the registration of shares of our common stock to be sold by the selling stockholder pursuant to this prospectus. Other than registration expenses, the selling stockholder will bear underwriting discounts, commissions, placement agent fees or other similar expenses payable with respect to sales of shares of our common stock.

| 9 |

| Table of Contents |

The resale of shares of common stock being offered by the selling stockholder, consisting of Warrant Shares underlying the Warrants issued to the selling stockholder pursuant to the Inducement Agreement, is being registered hereby to fulfill our contractual obligations under the Inducement Agreement. (See “Summary—Private Placement”).

The information in the table below and the footnotes thereto regarding shares of common stock to be owned after the offering assumes the sale of all shares being offered by the selling stockholder under this prospectus. The percentage of shares owned after the offering is based on 51,762,833 shares of common stock outstanding as of April 30, 2024. Unless otherwise indicated in the footnotes to this table, we believe that the selling stockholder has sole voting and investment power with respect to the shares of our common stock.

As used in this prospectus, the term “selling stockholder” includes the selling stockholder named below and any donees, pledgees, transferees or other successors-in-interest selling shares of our common stock received after the date of this prospectus from the selling stockholder as a gift, pledge, or other non-sale related transfer.

The number of shares in the column “Number of Shares of Common Stock Owned As of the Date Hereof” represents the number of shares of common stock that are actually owned as of the date of this prospectus, and does not represent the number of shares that the selling stockholder may otherwise be obligated to report as “beneficially owned” by the selling stockholder under other rules of the SEC. Please refer to the section titled “Security Ownership of Certain Beneficial Owners and Management” in our Annual Report on Form 10-K/A filed with the SEC on April 29, 2024 for information regarding beneficial ownership of our common stock.

The number of shares in the columns “Number of Shares of Common Stock Offered Hereby” and “Number of Shares of Common Stock Underlying Warrants Offered Hereby” represent all of the shares of our common stock that the selling stockholder may offer under this prospectus, without giving effect to the Beneficial Ownership Limitation (as defined below). The columns captioned “Number of Shares of Common Stock Owned After the Offering of All Common Stock Offered Hereby” and “Percentage of Shares of Common Stock to be Owned by Selling Stockholder After the Offering of All Common Stock Offered Hereby” assume the sale of all of the shares of our common stock offered by the selling stockholder under this prospectus and that the selling stockholder does not acquire any additional shares of our common stock before the completion of the offering under this prospectus, other than through the exercise of the Warrants. However, because the selling stockholder may sell all, some or none of the shares offered under this prospectus from time to time, or in another permitted manner, we cannot assure you as to the actual number of shares of our common stock that will be sold by the selling stockholder or that will be held by the selling stockholder after completion of any sales. The selling stockholder may sell some, all or none of the shares of our common stock offered under this prospectus. We do not know how long the selling stockholder will hold the Warrants, whether the selling stockholder will exercise the Warrants, and upon such exercise, how long the selling stockholder will hold the shares of common stock before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale of any of the shares of common stock.

Under the terms of the Warrants, the selling stockholder that holds Warrants may not exercise the Warrants to the extent such exercise would cause the selling stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares of common stock which would exceed 4.99% or 9.99%, as indicated in the table below, of the number of shares of our common stock outstanding following such exercise (for purposes of the denominator, immediately after giving effect to the issuance of shares of common stock to be issued upon the applicable exercise of such Warrants) (the Beneficial Ownership Limitation). Any increase in the Beneficial Ownership Limitation will not be effective until the 61st day after such notice is delivered to us. Readers are cautioned that the column representing the Beneficial Ownership Limitation should not be read as an indication of the selling stockholder’s current or future intended beneficial ownership and is being presented solely for informational purposes.

| 10 |

| Table of Contents |

| Name and Address |

| Number of Shares of Common Stock Owned As of the Date Hereof |

|

| Number of Shares of Common Stock Offered Hereby |

|

| Number of Shares of Common Stock Underlying Warrants Offered Hereby |

|

| Number of Shares of Common Stock Owned After the Offering of All Common Stock Offered Hereby |

|

| Percentage of Shares of Common Stock to be Owned by Selling Stockholder After the Offering of All Common Stock Offered Hereby |

|

| Beneficial Ownership Limitation |

| ||||||

| Armistice Capital, LLC(1) c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022 |

|

| 2,075,000 |

|

|

| 1,225,000 |

|

|

| 1,225,000 |

|

|

| 850,000 |

|

|

| 1.6 | % |

|

| 4.99 | % |

|

| (1) | The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the Master Fund from exercising that portion of the warrants that would result in the Master Fund and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. |

| 11 |

| Table of Contents |

We are registering the resale of shares of common stock issued to the selling stockholder to permit the resale of these shares of common stock by the holder of the shares of common stock from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholder of the shares of common stock. We will bear all fees and expenses incident to our obligation to register the shares of common stock.

The selling stockholder may sell all or a portion of the shares of common stock beneficially owned by it and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers, the selling stockholder will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common stock may be sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, that may involve crosses or block transactions. The selling stockholder also may use any one or more of the following methods when selling shares:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

|

| ● | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

|

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

|

| ● | an exchange distribution in accordance with the rules of the applicable exchange; |

|

| ● | privately negotiated transactions; |

|

| ● | settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part; |

|

| ● | broker-dealers may agree with the selling stockholder to sell a specified number of such shares at a stipulated price per share; |

|

| ● | through the writing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise; |

|

| ● | through the distribution of the Shares by any selling stockholder to its partners, members or stockholders; |

|

| ● | directly to one or more purchasers; |

|

| ● | through delayed delivery requirements; |

|

| ● | by pledge to secured debts and other obligations or any transfer upon the foreclosure under such pledge; |

|

| ● | a combination of any such methods of sale; and |

|

| ● | any other method permitted pursuant to applicable law. |

The selling stockholder also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, as permitted by that rule, or Section 4(a)(1) under the Securities Act, if available, or any other available exemption from the registration requirements of the Securities Act, rather than under this prospectus, provided that they meet the criteria and conform to the requirements of those exemptions.

Broker-dealers engaged by the selling stockholder may arrange for other broker-dealers to participate in sales. If the selling stockholder effect such transactions by selling shares of common stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholder or commissions from purchasers of the shares of common stock for whom they may act as agent or to whom they may sell as principal. Such commissions will be in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with FINRA Rule 5110.

| 12 |

| Table of Contents |

In connection with sales of the shares of common stock or otherwise, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholder may also sell shares of common stock short and if such short sale shall take place after the date that this Registration Statement is declared effective by the Commission, the selling stockholder may deliver shares of common stock covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholder may also loan or pledge shares of common stock to broker-dealers that in turn may sell such shares, to the extent permitted by applicable law. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). Notwithstanding the foregoing, the selling stockholder have been advised that they may not use shares registered on this registration statement to cover short sales of our common stock made prior to the date the registration statement, of which this prospectus forms a part, has been declared effective by the SEC.

The selling stockholder may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by it and, if they default in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended, amending, if necessary, the list of selling stockholder to include the pledgee, transferee or other successors in interest as selling stockholder under this prospectus. The selling stockholder also may transfer and donate the shares of common stock in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholder and any broker-dealer or agents participating in the distribution of the shares of common stock may be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act in connection with such sales. In such event, any commissions paid, or any discounts or concessions allowed to, any such broker-dealer or agent and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Selling Stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities of, including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act.

The selling stockholder has informed the Company that it is not a registered broker-dealer and does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the common stock. Upon the Company being notified in writing by the selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of common stock through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, a supplement to this prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act, disclosing (i) the name of such selling stockholder and of the participating broker-dealer(s), (ii) the number of shares involved, (iii) the price at which such the shares of common stock were sold, (iv) the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable, (v) that such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus, and (vi) other facts material to the transaction.

Under the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the shares of common stock registered pursuant to the shelf registration statement, of which this prospectus forms a part.

The selling stockholder and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the shares of common stock by the selling stockholder and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares of common stock.

| 13 |

| Table of Contents |

We will pay all expenses of the registration of the shares of common stock pursuant to the inducement agreement, including, without limitation, SEC filing fees, expenses of compliance with state securities or “blue sky” laws; provided, however, that the selling stockholder will pay all underwriting discounts and selling commissions, if any.

Unless otherwise indicated in the applicable prospectus supplement, certain legal matters in connection with the offering and the validity of the securities offered by this prospectus, and any supplement thereto, will be passed upon by Blank Rome LLP, Dallas, Texas. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

The consolidated balance sheets of ASP Isotopes Inc. and Subsidiaries as of December 31, 2023 and 2022, and the related consolidated statements of operations and comprehensive loss, changes in stockholders’ equity, and cash flows for each of the years then ended, have been audited by EisnerAmper LLP, independent registered public accounting firm, as stated in their report which is incorporated by reference, which report includes an explanatory paragraph about the existence of substantial doubt concerning the Company’s ability to continue as a going concern. Such financial statements have been incorporated by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities we are offering under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. You should rely only on the information contained in this prospectus or incorporated by reference. We have not authorized anyone else to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We must comply with the informational requirements of the Exchange Act, and we are required to file reports and proxy statements and other information with the SEC. You may read and copy these reports, proxy statements and other information on the SEC’s website at http://www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers like us that file electronically with the SEC. We maintain a website at www.aspisotopes.com. The information contained in, or that can be accessed through, our website is not incorporated by reference herein and is not part of this prospectus.

Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and in each instance we refer you to the copy of the contract or document filed as an exhibit to the registration statement, each such statement being qualified in all respects by such reference.

| 14 |

| Table of Contents |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We also incorporate by reference into this prospectus the documents listed below and any future filings made by us with the SEC (other than current reports or portions thereof furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items and other portions of documents that are furnished, but not filed, pursuant to applicable rules promulgated by the SEC) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of the registration statement, and (ii) after the effectiveness of the registration statement but prior to the termination of the offering of the securities covered by the applicable prospectus supplement:

| ● | our Annual Report on Form 10-K filed with the SEC on April 10, 2024, and as amended by that Form 10-K/A filed with the SEC on April 29, 2024; |

| ● | our Current Reports on Form 8-K filed on January 18, 2024, February 29, 2024 and April 9, 2024; and |

| ● | the description of the Company’s common stock contained in Exhibit 4.1 to the Company’s Annual Report on Form 10-K filed with the SEC on April 10, 2024, including any amendments or reports filed for the purpose of updating such description. |

We will furnish without charge to each person, including any beneficial owner, to whom this prospectus supplement and the accompanying prospectus is delivered, upon written or oral request, a copy of any document incorporated by reference. Requests should be addressed to 1101 Pennsylvania Avenue NW, Suite 300, Washington, D.C. 20004, Attn: Secretary. Copies of these filings are also available, without charge, on the SEC’s website at www.sec.gov and on our website www. aspisotopes.com as soon as reasonably practicable after they are filed electronically with the SEC. The information contained on our website is not part of this prospectus supplement or the accompanying prospectus.

In accordance with Rule 412 of the Securities Act, any statement contained in a document incorporated by reference in this prospectus supplement or the accompanying prospectus shall be deemed modified, superseded or replaced for the purposes of this prospectus supplement or the accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying prospectus or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement.

| 15 |

| Table of Contents |

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is a statement of the estimated expenses to be incurred by us in connection with the registration of the securities under this registration statement, all of which will be borne by us.

| SEC registration fee |

| $ | 649.11 |

|

| Accounting fees and expenses* |

| $ | 25,000.00 |

|

| Legal fees and expenses* |

| $ | 25,000.00 |

|

| Miscellaneous fees and expenses* |

| $ | 3,500.00 |

|

| Total* |

| $ | 54,149.11 |

|

| * | These fees are calculated based on the securities offered and the number of issuances and, accordingly, cannot be estimated at this time. |

Item 15. Indemnification of Directors and Officers

The registrant’s certificate of incorporation and bylaws provide for indemnification of the registrant’s directors and officers to the fullest extent permitted by law. Insofar as indemnification for liabilities under the Securities Act of 1933, as amended, or the Securities Act, may be permitted to directors, officers or controlling persons of the registrant pursuant to the registrant’s certificate of incorporation, bylaws and the Delaware General Corporation Law, or DGCL, the registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Section 102(b)(7) of the DGCL provides that a certificate of incorporation may include a provision that eliminates or limits the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the Company or its stockholders, (ii) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the DGCL, relating to prohibited dividends or distributions or the repurchase or redemption of stock or (iv) for any transaction from which the director derives an improper personal benefit. The registrant’s certificate of incorporation includes such a provision. As a result of this provision, the registrant and its stockholders may be unable to obtain monetary damages from a director for breach of his or her duty of care.

As permitted under the DGCL, the registrant has entered into indemnification agreements with its directors and officers, whereby it have agreed to indemnify its directors and officers to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the fact that such director or officer is or was a director, officer, employee or agent of the registrant, provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in, or not opposed to, the best interest of the registrant. At present, there is no pending litigation or proceeding involving a director or officer of the registrant regarding which indemnification is sought, nor is the registrant aware of any threatened litigation that may result in claims for indemnification.

The indemnification agreements also set forth certain procedures, presumptions and remedies that will apply in the event of a claim for indemnification thereunder.

Any underwriting agreement that we and the selling stockholder may enter into may provide for indemnification by any underwriters, of us, our directors, our officers who sign the registration statement, our controlling persons and the selling stockholder for some liabilities, including liabilities arising under the Securities Act.

| II-1 |

| Table of Contents |

Item 16. Exhibits and Financial Statement Schedules

(a) Exhibits.

____________

| * | Filed herewith. |

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; |

| II-2 |

| Table of Contents |

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement or are contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

| (i) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date. |

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

| (i) | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| (ii) | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| II-3 |

| Table of Contents |

| (iii) | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

(6) That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

| II-4 |

| Table of Contents |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Washington, DC, on May 9, 2024.

|

| ASP ISOTOPES INC. |

| |

|

|

|

| |

|

| By | /s/ Paul E. Mann |

|

|

|